EX-99.1

Published on April 14, 2022

www.ardaghmetalpackaging.com

Ardagh Metal Packaging S.A.

56, rue Charles Martel

L-2134 Luxembourg, Luxembourg

T: +352 26 25 85 - 55

F: +352 26 38 94 - 44

E: enquiries@ardaghgroup.com

April 14, 2022

Dear Shareholder,

You are cordially invited to exercise your voting right for the 2022 Annual General Meeting of Shareholders (the “Annual General Meeting”) of Ardagh Metal Packaging S.A. (the “Company”) to be held at 12:00 p.m. Luxembourg time on May 19, 2022, by way of proxy without physical presence in accordance with the Luxembourg law of September 23, 2020, as amended. Information concerning the matters to be considered and voted upon at the Annual General Meeting is set out in the attached Convening Notice and Proxy Statement.

The Board of Directors has fixed March 29, 2022 (10:00 p.m. Luxembourg time, 4:00 p.m. EDT) as the record date for the Annual General Meeting (the “Record Date”), and only holders of record of shares at such time will be entitled to notice of or to vote at the Annual General Meeting or any adjournment or postponement thereof.

In order to exercise your voting right for the Annual General Meeting and to be represented by a proxyholder designated by the Company in accordance with the Luxembourg law of September 23, 2020, as amended, please follow the instructions you received.

Please note that proxy cards must be received by the tabulation agent (Computershare), no later than 7:00 p.m. Luxembourg time, 1:00 p.m. EDT, on May 17, 2022, in order for such votes to be taken into account.

On behalf of the Board of Directors, we thank you for your continued support.

Sincerely,

Paul Coulson

Chairman

Convening Notice

to the Annual General Meeting of Shareholders

to be held on May 19, 2022 at 12:00 p.m. Luxembourg time without physical presence in accordance with the Luxembourg law of September 23, 2020, as amended

April 14, 2022

Dear Shareholder,

The Board of Directors of Ardagh Metal Packaging S.A. (the “Company”) is pleased to invite you to exercise your voting right for the 2022 Annual General Meeting of Shareholders (the “Annual General Meeting”), to be held on May 19, 2022 at 12:00 p.m. Luxembourg time, by way of proxy without physical presence in accordance with the Luxembourg law of September 23, 2020, as amended, with the following agenda:

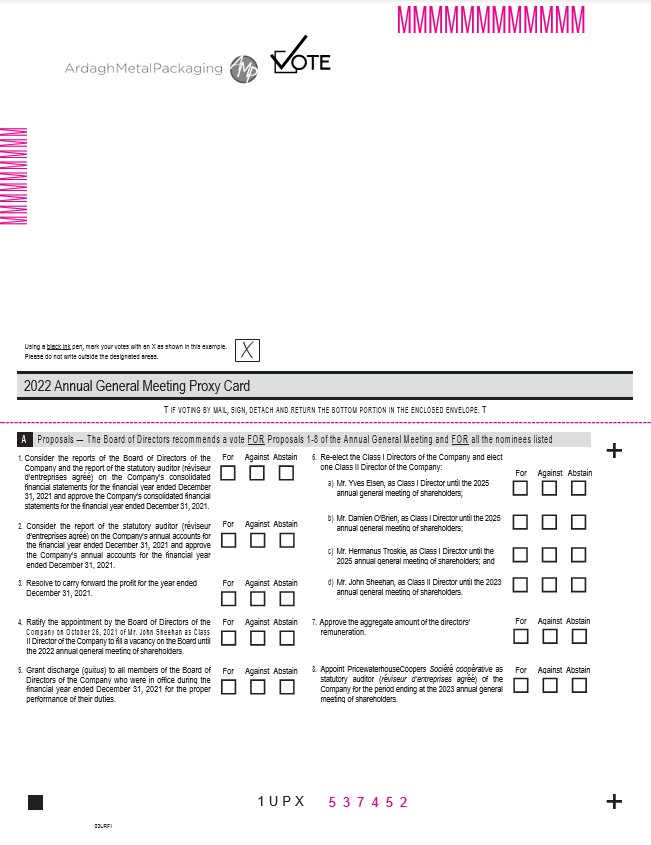

Agenda of the Annual General Meeting

| 1. | Consider the reports of the Board of Directors of the Company and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s consolidated financial statements for the financial year ended December 31, 2021 and approve the Company’s consolidated financial statements for the financial year ended December 31, 2021. |

| 2. | Consider the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s annual accounts for the financial year ended December 31, 2021 and approve the Company’s annual accounts for the financial year ended December 31, 2021. |

| 3. | Resolve to carry forward the profit for the year ended December 31, 2021. |

| 4. | Ratify the appointment by the Board of Directors of the Company on October 26, 2021 of Mr. John Sheehan as Class II Director of the Company to fill a vacancy on the Board until the 2022 annual general meeting of shareholders. |

| 5. | Grant discharge (quitus) to all members of the Board of Directors of the Company who were in office during the financial year ended December 31, 2021 for the proper performance of their duties. |

| 6. | Re-elect the Class I Directors of the Company and elect one Class II Director of the Company: |

a) |

Mr. Yves Elsen, as Class I Director until the 2025 annual general meeting of shareholders; |

b) |

Mr. Damien O’Brien, as Class I Director until the 2025 annual general meeting of shareholders; |

c) Mr. Hermanus Troskie, as Class I Director until the 2025 annual general meeting of shareholders; and

d) Mr. John Sheehan, as Class II Director until the 2023 annual general meeting of shareholders.

| 7. | Approve the aggregate amount of the directors’ remuneration. |

| 8. | Appoint PricewaterhouseCoopers Société coopérative as statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the 2023 annual general meeting of shareholders. |

Pursuant to articles 21 and 22 of our Articles of Association, the Annual General Meeting will validly deliberate on its agenda with the quorum requirement of at least one-third (1/3) of our issued share capital, and the resolutions at the Annual General Meeting will be adopted by a simple majority of the votes validly cast.

Any shareholder who holds one or more common share(s) of the Company on March 29, 2022 at 10:00 p.m. Luxembourg time, 4:00 p.m. EDT (the “Record Date”) will be entitled to vote at the Annual General Meeting by submitting a proxy card by 7:00 p.m. Luxembourg time (1:00 p.m. EDT), on May 17, 2022.

Please consult the Proxy Statement enclosed herewith, and also available on the Company’s website, as to your representation at the Annual General Meeting by way of proxy. Copies of the Company’s consolidated financial statements and its annual accounts for the financial year ended December 31, 2021 together with the reports of the Board of Directors and the statutory auditor are available at www.ardaghmetalpackaging.com/corporate/investors/agm. Please note that proxy cards must be received by the tabulation agent (Computershare), no later than 7:00 p.m. Luxembourg time, 1:00 p.m. EDT, on May 17, 2022, in order for such votes to be taken into account.

Please note that in response to the COVID‐19 pandemic and in accordance with the Luxembourg law of September 23, 2020, as amended, which allows for meetings of shareholders to be held without requiring their physical presence and which provides for the exercise of the shareholders’ rights through their representation by a proxyholder, the Annual General Meeting will be held without the shareholders’ physical presence. These measures have been prompted by the COVID‐19 crisis in order to allow Luxembourg companies to function normally and hold their meetings without the shareholders’ physical presence to prevent the spreading of the virus at such meetings.

Sincerely,

Paul Coulson

Chairman

on behalf of the Board of Directors

ARDAGH METAL PACKAGING S.A.

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

MAY 19, 2022

GENERAL INFORMATION

This Proxy Statement is being provided to solicit proxies on behalf of the Board of Directors of Ardagh Metal Packaging S.A. (the “Company,” “AMPSA,” “we,” “our” or “us”) for use at the 2022 Annual General Meeting of Shareholders (the “Annual General Meeting”) to be held on May 19, 2022, at 12:00 p.m. Luxembourg time, without the shareholders’ physical presence in accordance with the Luxembourg law of September 23, 2020, as amended, which allows for meetings of shareholders to be held without requiring their physical presence and which provides for the exercise of the shareholders’ rights through their representation by a proxyholder, and any adjournment or postponement thereof. This Proxy Statement is available on our website at www.ardaghmetalpackaging.com/corporate/investors/agm, together with the Company’s consolidated financial statements and its annual accounts for the financial year ended December 31, 2021 and our Annual Report on Form 20-F for the year ended December 31, 2021 (the “Annual Report on Form 20-F”). The Proxy Statement also will be made available to our “street name” holders (meaning beneficial owners with their shares held through a bank, brokerage firm or other record owner) and registered shareholders as at the Record Date (as defined below) through the delivery methods described below.

This Proxy Statement, together with the Convening Notice containing the agenda and the proxy card with reply envelope, are hereinafter referred to as the “Proxy Materials”.

Foreign Private Issuer

We are a “foreign private issuer” within the meaning of Rule 3b-4 of the U.S. Securities Exchange Act of 1934, as amended, and as a result, we are not required to mandatorily comply with U.S. federal proxy requirements.

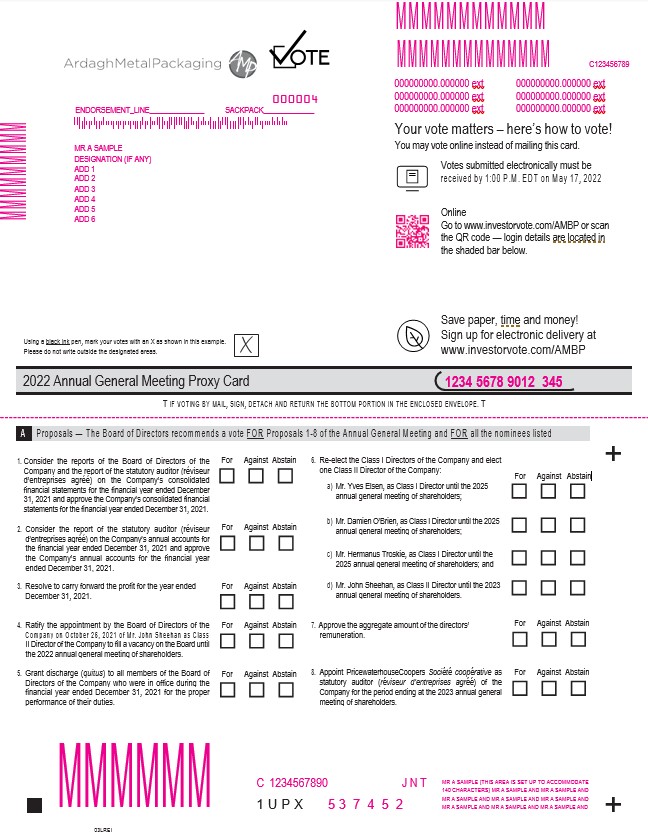

How May the Annual General Meeting Materials Be Accessed?

| (a) | Street name holders |

We have elected to provide access to our Proxy Materials over the internet. Accordingly, we are sending a notice (the “Information Notice”) on April 14, 2022 regarding internet availability of Proxy Materials to our street name holders of record as of 10:00 p.m. Luxembourg time, 4:00 p.m. EDT, on March 29, 2022 (the “Record Date”). You will have the ability to access the Proxy Materials, the Company’s consolidated financial statements and its annual accounts for the financial year ended December 31, 2021, our Annual Report on Form 20-F on the website referred to in the Information Notice (www.ardaghmetalpackaging.com/corporate/investors/agm) or street name holders may request to receive a printed set of the Proxy Materials. Instructions on how to access the Proxy Materials either by viewing them online or by requesting a copy may be found in the Information Notice. You will not receive a printed copy of the Proxy Materials unless you have requested one when setting up your brokerage account or request one in the manner set forth in the Information Notice. This permits us to conserve natural resources and reduces our printing costs, while giving shareholders a convenient and efficient way to access our Proxy Materials and to exercise the voting rights attendant to their shares at the Annual General Meeting.

| (b) | Registered shareholders |

We are mailing the Proxy Materials on April 14, 2022 to all registered shareholders of our common shares as at the Record Date.

Who May Vote at the Annual General Meeting?

Only registered shareholders or street name holders of our shares as at the Record Date will be entitled to notice of the Annual General Meeting and to vote at the Annual General Meeting through their legal proxy holders designated by the Company as set forth on the proxy card. On the Record Date, 603,308,060 common shares were issued and outstanding. Each common share is entitled to one vote at the Annual General Meeting.

What Constitutes a Quorum?

At any ordinary general meeting (including the Annual General Meeting), the holders of in excess of one-third (1/3) of the share capital in issue represented by proxy at the meeting will form a quorum for the transaction of business. Abstentions, described below, are counted as shares present for purposes of determining whether a quorum exists.

What Are Broker Non-Votes and Abstentions?

Broker non-votes occur when brokers holding shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote their shares and the broker is unable to vote the shares in its discretion in the absence of an instruction. An abstention occurs when a shareholder withholds such shareholder’s vote on a particular matter by checking the “ABSTAIN” box on the proxy card.

Your broker will NOT be able to vote your shares with respect to any of the proposals or other matters considered at the Annual General Meeting, unless you have provided instructions to your broker. We strongly encourage you to provide instructions to your broker to vote your shares and exercise your right as a shareholder. A vote will not be cast in cases where a broker has not received an instruction from the beneficial owner.

With respect to all of the proposals or other matters considered at the Annual General Meeting, only those votes cast “FOR” or “AGAINST” are counted for the purposes of determining the number of votes cast with respect to each such proposal.

Broker non-votes and abstentions are not considered votes cast and have no effect on the outcome of any of the proposals.

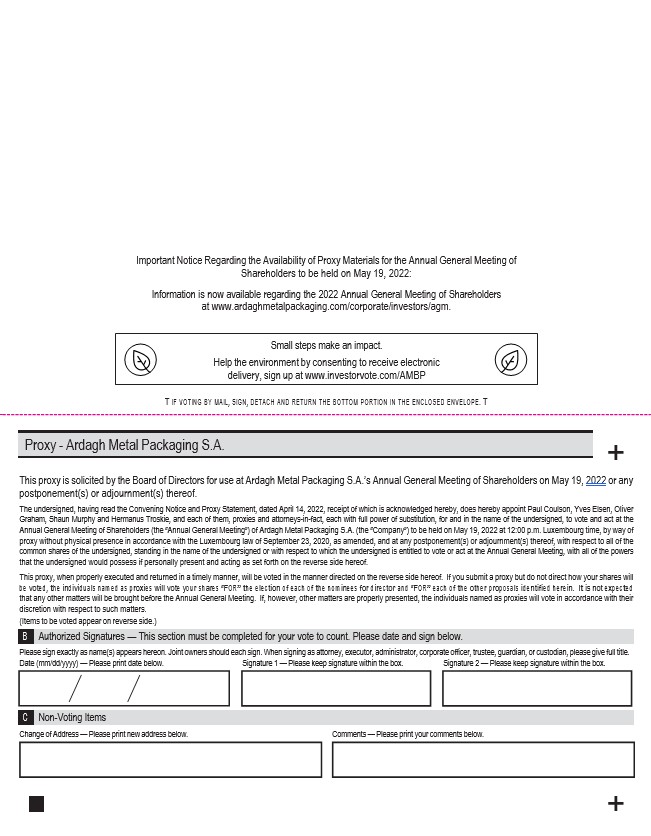

What Is the Process for Voting and Revocation of Proxies?

If you are a registered shareholder, you can vote by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope. Please note that in response to the COVID‐19 pandemic and in accordance with the Luxembourg law of September 23, 2020, as amended, which allows for meetings of shareholders to be held without requiring their physical presence and which provides for the exercise of the shareholders’ rights through their representation by a proxy holder, the Annual General Meeting will be held without the shareholders’ physical presence, and, accordingly, you may not vote in person.

If your shares are held in “street name”, you will receive instructions from your bank, brokerage firm or other record owner. You must follow the instructions of the bank, brokerage firm or other record owner in order for your shares to be voted.

The Company will retain an independent tabulator to receive and tabulate the proxies.

If you submit a proxy and direct how your shares will be voted, the individuals named as proxies will vote your shares in the manner you indicate. If you submit a proxy but do not direct how your shares will be voted, the individuals named as proxies will vote your shares “FOR” the election of each of the nominees for director and “FOR” each of the other proposals identified herein.

It is not expected that any other matters will be brought before the Annual General Meeting. If, however, other matters are properly presented, the individuals named as proxies will vote in accordance with their discretion with respect to such matters.

A registered shareholder who has given a proxy may revoke it at any time before it is exercised at the Annual General Meeting by:

| ● | delivering a written notice on or before May 17, 2022, at 7:00 p.m. Luxembourg time, 1:00 p.m. EDT at the address given below, stating that the previously delivered proxy is revoked; or |

| ● | signing and delivering on or before May 17, 2022, at 7:00 p.m. Luxembourg time, 1:00 p.m. EDT to the address given below a subsequently dated proxy card dated prior to the vote at the Annual General Meeting. |

If you are a registered shareholder, you may request a new proxy card by calling the Company at its registered office in Luxembourg at +352 26 25 85 55.

Registered shareholders should send any written notice or proxy card by (i) regular mail to Ardagh Metal Packaging S.A., c/o Computershare, PO Box 505000, Louisville, KY 40233-5000, or (ii) by courier or U.S. overnight mail to Ardagh Metal Packaging S.A., c/o Computershare, 462 South 4th Street, Suite 1600, Louisville, KY 40202 (Telephone: +1 800-736-3001 and from outside the US +1 781 575 3100).

Any street name holder may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the shares. Your last voting instructions, prior to or at the Annual General Meeting, are the voting instructions that will be taken into account.

Who May Attend the Annual General Meeting?

Please note that in response to the COVID‐19 pandemic and in accordance with Luxembourg and international travel restrictions and limitations of large gatherings and in particular the Luxembourg law of September 23, 2020, as amended, which allows for meetings of shareholders to be held without requiring their physical presence and which provides for the exercise of the shareholders’ rights through their representation by a proxy holder, the Annual General Meeting will be held without the shareholders’ physical presence. These measures have been prompted by the COVID‐19 pandemic in order to allow Luxembourg companies to function normally and hold their meetings without shareholders’ physical presence to prevent the spreading of the virus at such meetings.

Members of the Board of Directors will join the Annual General Meeting by teleconference and represent the shareholders of the Company pursuant to the power granted to them under the proxy cards.

What Is the Process for the Solicitation of Proxies?

We will pay the cost of soliciting proxies for the Annual General Meeting. We may solicit by mail, telephone, personal contact and electronic means and arrangements are made with brokerage houses and other custodians, nominees and fiduciaries to send the Information Notice, and if requested, Proxy Materials, to beneficial owners. Upon request, we will reimburse them for their reasonable expenses. In addition, our directors, officers and employees may solicit proxies, either in-person or by telephone, facsimile or written or electronic mail (without additional compensation). Shareholders are encouraged to return their proxies promptly.

PROPOSAL WITH RESPECT TO AGENDA ITEMS NO. 1 AND 2:

APPROVAL OF CONSOLIDATED FINANCIAL STATEMENTS AND ANNUAL ACCOUNTS

At the Annual General Meeting, the Board of Directors will present the report on conflicts of interest, the management report on the Company’s consolidated financial statements, as well as the reports of the statutory auditor (réviseur d’entreprises agréé) on the consolidated financial statements and the annual accounts for the financial year ended December 31, 2021. The management report and the statutory auditor’s reports are available on our website at www.ardaghmetalpackaging.com/corporate/investors/agm. After such presentation, the following resolutions will be put before the Annual General Meeting for approval:

Resolved: The Annual General Meeting, after having reviewed the report of the Board of Directors of the Company and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s consolidated financial statements for the financial year ended December 31, 2021, hereby approves the consolidated financial statements of the Company for the financial year ended December 31, 2021 in their entirety.

Resolved: The Annual General Meeting, after having reviewed the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s annual accounts for the financial year ended December 31, 2021, hereby approves the annual accounts of the Company for the financial year ended December 31, 2021 in their entirety.

Vote Required and Board Recommendation

Approval of these proposals requires the affirmative vote of a simple majority of votes validly cast on such resolution by shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolutions will fail.

Our Board of Directors recommends a vote “FOR” the approval of the Company’s consolidated financial statements and its annual accounts for the financial year ended December 31, 2021.

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 3:

APPROVAL OF ALLOCATION OF ANNUAL RESULTS

The Board of Directors will propose that the Annual General Meeting approves to carry forward the profit for the year ended December 31, 2021.

Resolved: The Annual General Meeting hereby approves to carry forward the profit for the year as recommended by the Board of Directors of the Company.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the approval of the allocation of our annual results.

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 4:

RATIFICATION OF APPOINTMENT OF MR. JOHN SHEEHAN

On October 26, 2021, the Board of Directors appointed Mr. John Sheehan as Class II Director of the Company to fill a vacancy on the Board until the 2022 annual general meeting of shareholders, pursuant to its authority under the Company’s Articles of Association.

Resolved: The Annual General Meeting hereby ratifies the appointment on October 26, 2021 by the Board of Directors of John Sheehan as a Class II Director of the Company to fill a vacancy on the Board until the 2022 annual general meeting of shareholders.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the ratification of the appointment of John Sheehan as a Class II Director of the Company to fill a vacancy on the Board until the 2022 annual general meeting of shareholders.

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 5:

APPROVAL OF DISCHARGE TO DIRECTORS FOR PERFORMANCE

Under Luxembourg law, the shareholders are asked to vote on the discharge (quitus) of the directors with respect to the performance of their duties during the completed financial year. At the Annual General Meeting, the shareholders will be asked to approve the following resolution with respect to the discharge of our directors who served during the year ended December 31, 2021:

Resolved: The Annual General Meeting hereby grants discharge (quitus) to the members of the Board of Directors who were in office during the financial year ended December 31, 2021 for the proper performance of their duties.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the approval of discharge to the members of the Board of Directors.

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 6:

RE-ELECTION OF CLASS I DIRECTORS OF THE COMPANY AND ELECTION OF ONE CLASS II DIRECTOR OF THE COMPANY

Our Board of Directors consists of eleven (11) directors. Our Articles of Association provide that our Board of Directors will consist of no fewer than three (3) directors and no more than fifteen (15) directors, with the number of directors within that range being determined by the Board of Directors from time to time. Pursuant to our Articles of Association, our directors are appointed by the annual general meeting of shareholders for a period of one to three years.

The Board of Directors has nominated Messrs. Yves Elsen, Damien O’Brien and Hermanus Troskie for re-election as directors of the Company as Class I Directors, with terms of office expiring at the annual general meeting of shareholders to be held in 2025, and Mr. John Sheehan for election as Class II Director, with a term of office expiring at the annual general meeting of shareholders to be held in 2023. All nominees are presently members of the Board of Directors.

As provided in the Company’s Articles of Association, except in the case of a vacancy in the office of director filled by the Board as described therein, the Company may elect directors by resolution adopted at an ordinary general meeting of shareholders (including an annual general meeting).

Nominees for Re-election to the Company’s Board of Directors

Information concerning the nominees for re-election to the Board of Directors is set forth below:

Name |

Age |

Position |

|---|---|---|

64 |

Non-Executive Director |

|

Damien O’Brien |

66 |

Non-Executive Director |

Hermanus Troskie |

51 |

Non-Executive Director |

John Sheehan |

56 |

Director |

Yves Elsen is CEO and managing partner of HITEC Luxembourg S.A., a Luxembourg-based industrial and technology company serving contractors in over 20 countries around the world. Prior to this, Mr. Elsen founded and led SATLYNX S.A., following extensive experience with listed satellite operator SES—Société Européenne des Satellites S.A. He was a member of the supervisory board of Villeroy & Boch AG from 2013 to 2019 and its Chairman from 2017. Mr. Elsen is Chairman of the board of governors of the University of Luxembourg. He is an independent director and is a member of the Audit Committee and the Nominating and Governance Committee.

Damien O’Brien has served as CEO of Egon Zehnder from 2008 to 2014 and as its Chairman from 2010 to 2018. Mr. O’Brien joined Egon Zehnder in 1988 and since then he has been based in Australia, Asia and Europe. He is also a member of the boards of IMD Business School in Lausanne, Switzerland, and St. Vincents Health Australia. Mr. O’Brien is an independent director and is a member of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee.

Hermanus Troskie has been a director of Ardagh since 2009. He is an independent director and a member of the Compensation Committee, the Finance Committee and the Nominating and Governance Committee. Mr. Troskie is the CEO of Corporate, Legal and Tax Advisory at Stonehage Fleming, the international Family Office. He has extensive experience in the areas of international corporate structuring, cross-border financing and capital markets, with a particular interest in integrated structuring for entrepreneurs and their businesses. Mr. Troskie is a director of companies within the Yeoman group of companies, and other private and public companies. He qualified as a South African Attorney in 1997, and as a Solicitor of the Senior Courts of England and Wales in 2001. Mr. Troskie is based in Luxembourg.

John Sheehan was appointed Chief Financial Officer and Director of Ardagh Group S.A. in 2021, having previously been Director of Corporate Development and Investor Relations. Prior to joining Ardagh Group S.A. in 2012, Mr. Sheehan spent twelve years in the equity capital markets with Investec, RBS and NCB, covering a range of sectors. Mr. Sheehan qualified as a Chartered Accountant with PriceWaterhouseCoopers.

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

Resolved: The Annual General Meeting hereby approves the re-election of Messrs. Yves Elsen, Damien O’Brien and Hermanus Troskie, each as a Class I Director of the Company for a term ending at the 2025 annual

general meeting of shareholders and the election of Mr. John Sheehan as a Class II Director of the Company for a term ending at the 2023 annual general meeting of shareholders.

Vote Required and Board Recommendation

The re-election of each nominee for director requires the affirmative vote of a simple majority of votes validly cast on such matter by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the re-election and the election of the four directors named above to terms that run until the annual general meetings of shareholders indicated above.

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 7:

APPROVAL OF THE AGGREGATE AMOUNT OF THE DIRECTORS’ REMUNERATION

We have established a compensation program for our independent non-employee directors for their service on the Board of Directors and any committees of the Board. The aggregate amount of our independent non-employee directors’ compensation as proposed by the Board of Directors for the year 2022 is approximately $1,650,000.

The independent non-employee directors’ compensation program will allow each independent non-employee director the opportunity to elect to receive common shares in lieu of a portion of the annual cash retainer payable to the independent non-employee director under the program. We also reimburse our independent non-employee directors for reasonable out-of-pocket expenses incurred in connection with the performance of their duties as directors, including, without limitation, travel expenses in connection with their attendance in-person at Board of Directors and committee meetings. Directors who are employees do not receive any compensation for their services as directors.

We refer to the arrangements described above as the “Remuneration Arrangements”.

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

Resolved: The Annual General Meeting hereby approves the Remuneration Arrangements with respect to the directors of the Company for the year 2022.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the approval of independent non-executive directors’ remuneration for the year 2022.

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 8:

APPROVAL OF APPOINTMENT OF STATUTORY AUDITOR

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

Resolved: The Annual General Meeting hereby approves the appointment of PricewaterhouseCoopers Société coopérative as approved statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the 2023 annual general meeting of shareholders.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the appointment of PricewaterhouseCoopers Société coopérative as approved statutory auditor (réviseurs d’entreprises agréé) for the period ending at the 2023 annual general meeting of shareholders.

CORPORATE GOVERNANCE

We are exempt from certain corporate governance requirements of the New York Stock Exchange (“NYSE”) by virtue of being a “foreign private issuer”. Although our foreign private issuer status exempts us from most of the NYSE’s corporate governance requirements, we intend to voluntarily comply with these requirements, except those from which we would be exempt by virtue of being a “controlled company”, as described below.

Controlled Company

Our common shares are listed on the NYSE. Under the NYSE’s current listing standards, we qualify for and avail ourselves of certain of the controlled company exemptions under the corporate governance rules of the NYSE. As a controlled company, we are not required to have (1) a majority of “independent directors” on our Board of Directors, as defined under the rules of the NYSE, (2) a compensation committee and a nominating and governance committee composed entirely of “independent directors” with written charters addressing each committee’s purpose and responsibilities or (3) an annual performance evaluation of the compensation and nominating and governance committees. As a controlled company, we utilize certain of these exemptions, including that although we have adopted charters for our audit, compensation and nominating and governance committees, our compensation and nominating and governance committees are not composed entirely of independent directors.

The controlled company exemption does not modify the independence requirements for the audit committee, which require that our audit committee be composed of at least three members, each of whom is independent. All of our audit committee members are independent directors in accordance with the NYSE and the Securities and Exchange Commission (“SEC”) requirements for a company listed on the NYSE.

For a list of our major shareholders and information relating to their ownership of our common shares, please see Item 7A. “Major Shareholders and Related Party Transactions—Major shareholders” in our Annual Report on Form 20-F.

Board of Directors

Composition of Our Board of Directors

Our Board of Directors currently consists of eleven (11) members divided into three classes. Our Board of Directors consists of such number of directors as the general meeting of shareholders may from time to time determine, provided that the Board of Directors is composed at all times of no fewer than three (3) directors and no more than fifteen (15) directors. For information concerning our officers, directors and senior management, please see Item 6A. “Directors, Senior Management and Employees—Directors and Officers” in our Annual Report on Form 20-F.

Election of Directors

The holders of the shares have the right to elect the Board of Directors at a general meeting of shareholders by a simple majority of the votes validly cast. The existing directors have the right to appoint persons to fill vacancies, which persons may hold office until the next following annual general meeting.

Our Board of Directors is classified into three classes of directors. Our current Class I Directors are Yves Elsen, Damien O’Brien, and Hermanus Troskie, with terms of office expiring at the Company’s 2022 annual general meeting of shareholders. Each of the Class I Directors has been nominated for re-election at the Annual General Meeting, with terms of office expiring at the Company’s 2025 annual general meeting of shareholders. Our current Class II Directors are Shaun Murphy, Oliver Graham and Elizabeth Marcellino, with terms of office expiring at the Company’s 2023 annual general meeting of shareholders, and Mr. John Sheehan, whose mandate expires at the 2022 Annual General meeting and who has been nominated for election at the

2022 Annual General Meeting as a Class II Director with a term of office expiring at the Company’s 2023 annual general meeting of shareholders. Our current Class III Directors are Paul Coulson, Abigail Blunt, The Rt. Hon. the Lord Hammond of Runnymede and Edward White, with terms of office expiring at the Company’s 2024 annual general meeting of shareholders.

Experience of Directors

We believe that the composition of the Board of Directors, which includes a broad spread of nationalities, backgrounds and expertise, provides the breadth and depth of skills, knowledge and experience that are required to effectively lead an internationally diverse business with interests spanning three continents and ten individual countries.

We believe that our independent non-executive directors have broad-based international business expertise and have gained significant and relevant industry specific expertise over a number of years. The composition of the Board of Directors reflects the need to maintain a balance of skills, knowledge and experience.

The independent non-executive directors use their broad-based skills, diverse range of business and financial experiences and international backgrounds in reviewing and assessing any opportunities or challenges facing the Company and play an important role in developing the Company’s strategy and scrutinizing the performance of management in meeting the Company’s goals and objectives.

We expect our Board members collectively to have the experience, qualifications, attributes and skills to effectively oversee the management of the Company, including a high degree of personal and professional integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing the Company, a willingness to devote the necessary time to Board duties, a commitment to representing the best interests of the Company and a dedication to enhancing shareholder value.

Committees of the Board of Directors

Our Board of Directors has six standing committees: an executive committee, an audit committee, a compensation committee, a nominating and governance committee, a finance committee and a sustainability committee. The members of each committee are appointed by the Board of Directors and serve until their successors are elected and qualified, unless they are earlier removed or they resign. Each of the committees reports to the Board of Directors as it deems appropriate and as the Board of Directors may request. For information concerning the composition, duties and responsibilities of the committees, please see Item 6C. “Directors, Senior Management and Employees—Board practices” in our Annual Report on Form 20-F. In the future, our Board of Directors may establish other committees, as it deems appropriate, to assist it with its responsibilities. The charters for our executive, audit, compensation, nominating and governance, finance and sustainability committees are publicly available on our website at www.ardaghmetalpackaging.com/corporate/investors/governance.

Code of Conduct

Our Board of Directors has adopted a code of conduct that establishes the standards of ethical conduct applicable to all of our directors, officers, employees, and, as applicable, consultants and contractors. The code addresses, among other things, competition and fair dealing, conflicts of interest, financial matters and external reporting, compliance with applicable governmental laws, rules and regulations, company funds and assets, and confidentiality requirements and the process for reporting violations of the code, employee misconduct, conflicts of interest or other violations. Any waiver of the code with respect to any director or executive officer

will be promptly disclosed and posted on our website. Amendments to the code will be promptly disclosed and posted on our website. The code is publicly available on our website at www.ardaghmetalpackaging.com/corporate/investors/governance and in print to any shareholder who requests a copy.

Corporate Governance Guidelines

Our Board of Directors has adopted corporate governance guidelines that serve as a framework within which our Board of Directors and its committees operate. These guidelines cover a number of areas including the composition of the Board of Directors, Board membership criteria and director qualifications, director responsibilities, Board agenda, roles of the chairman of the Board of Directors and the chief executive officer, meetings of independent directors, Board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning. Our nominating and governance committee reviews our corporate governance guidelines periodically and, if necessary, recommends changes to our Board of Directors. Additionally, our Board of Directors has adopted independence standards as part of our corporate governance guidelines. A copy of our corporate governance guidelines is posted on our website at www.ardaghmetalpackaging.com/corporate/investors/governance.

SHAREHOLDER COMMUNICATIONS

Shareholders and interested parties may contact any of the Company’s directors, including the Chairman, the non-management directors as a group, the chair of any committee of the Board of Directors or any committee of the Board by writing to them as follows:

Ardagh Metal Packaging S.A.

56, rue Charles Martel

L-2134 Luxembourg, Luxembourg

Attn: Company Secretary

Concerns relating to accounting, internal controls or auditing matters should be communicated to the Company through the Company Secretary and will be handled in accordance with the procedures established by the audit committee with respect to such matters.

PROPOSALS OF SHAREHOLDERS

Shareholders who together hold at least ten percent (10%) of the share capital and intend to have an item added to the agenda of the 2022 Annual General Meeting of Shareholders must comply with the requirements contained in article 19.2 of our Articles of Association. We reserve the right (subject to Luxembourg law) to reject, rule out of order or take other appropriate action with respect to any proposal or nomination that does not comply with these and other applicable requirements.

WHERE YOU CAN FIND MORE INFORMATION

Ardagh Metal Packaging S.A. files annual and special reports and other information with the SEC.

The SEC filings of Ardagh Metal Packaging S.A. are also available to the public on the SEC’s internet website at www.sec.gov. In addition, the SEC filings of Ardagh Metal Packaging S.A. are also available to the public on the website of Ardagh Metal Packaging S.A., www.ardaghmetalpackaging.com. Information contained on the website of Ardagh Metal Packaging S.A. is not incorporated by reference into this document, and you should not consider information contained on that website as part of this document.

Important Notice Regarding the Availability of Proxy Materials for the

Annual General Meeting to be held on May 19, 2022

Information is now available regarding the 2022 Annual General Meeting of Shareholders (the “Annual General Meeting”) at www.ardaghmetalpackaging.com/corporate/investors/agm.

YOUR VOTE IS IMPORTANT. OUR BOARD OF DIRECTORS URGES YOU TO

VOTE BY MARKING, DATING, SIGNING AND RETURNING A PROXY CARD.

With respect to all of the proposals and matters considered at the Annual General Meeting, shares held through a broker or other intermediary will not be voted unless the beneficial holder notifies the broker or other intermediary through which the shares are held with instructions regarding how to vote. We strongly encourage

you to provide instructions to your broker or other intermediary to vote your shares and exercise your right as a shareholder.

Please note that in response to the COVID‐19 pandemic and in accordance with Luxembourg and international travel restrictions and limitations of large gatherings and in particular the Luxembourg law of September 23, 2020, as amended, which allows for meetings of shareholders to be held without requiring their physical presence and which provides for the exercise of the shareholders’ rights through their representation by a proxyholder, the Annual General Meeting will be held without the shareholders’ physical presence. These measures have been prompted by the COVID‐19 pandemic in order to allow Luxembourg companies to function normally and hold their meetings without the shareholders’ physical presence to prevent the spreading of the virus at such meetings.

Please follow the instructions you received to authorize a proxy to vote your shares as soon as possible to ensure that your shares are represented at the Annual General Meeting.

Luxembourg

April 14, 2022