EX-99.3

Published on April 14, 2022

Exhibit 99.3

Ardagh Metal Packaging S.A.

Audited Annual Accounts for the period from 20 January 2021 (Date of incorporation) to 31 December 2021

56, rue Charles Martel

L-2134 Luxembourg, Luxembourg R.C.S.: B 251465

Share Capital: EUR 6,032,972.87

Table of Contents

Audited Annual Accounts of Ardagh Metal Packaging S.A. for the period from 20 January 2021 to 31 December 2021

1

Directors and Other Information

Directors

Paul Coulson Abigail Blunt Yves Elsen John Sheehan Oliver Graham

The Rt. Hon. The Lord Hammond of Runnymede Elizabeth Marcellino

Shaun Murphy Damien O’Brien Hermanus Troskie Edward White

Registered Office

56, rue Charles Martel L-2134 Luxembourg Luxembourg

Registre du Commerce et des Sociétés B 251465

Auditors

PricewaterhouseCoopers, Société coopérative Réviseur d’Entreprises agréé

2, rue Gerhard Mercator L-1014 Luxembourg

2

To the Shareholders of

Ardagh Metal Packaging S.A. Our opinion

In our opinion, the accompanying annual accounts give a true and fair view of the financial position of

Ardagh Metal Packaging S.A. (the “Company”) as at 31 December 2021, and of the results of its operations for the period from 20 January 2021 (date of incorporation) to 31 December 2021 in accordance with Luxembourg legal and regulatory requirements relating to the preparation and presentation of the annual accounts.

What we have audited

The Company’s annual accounts comprise:

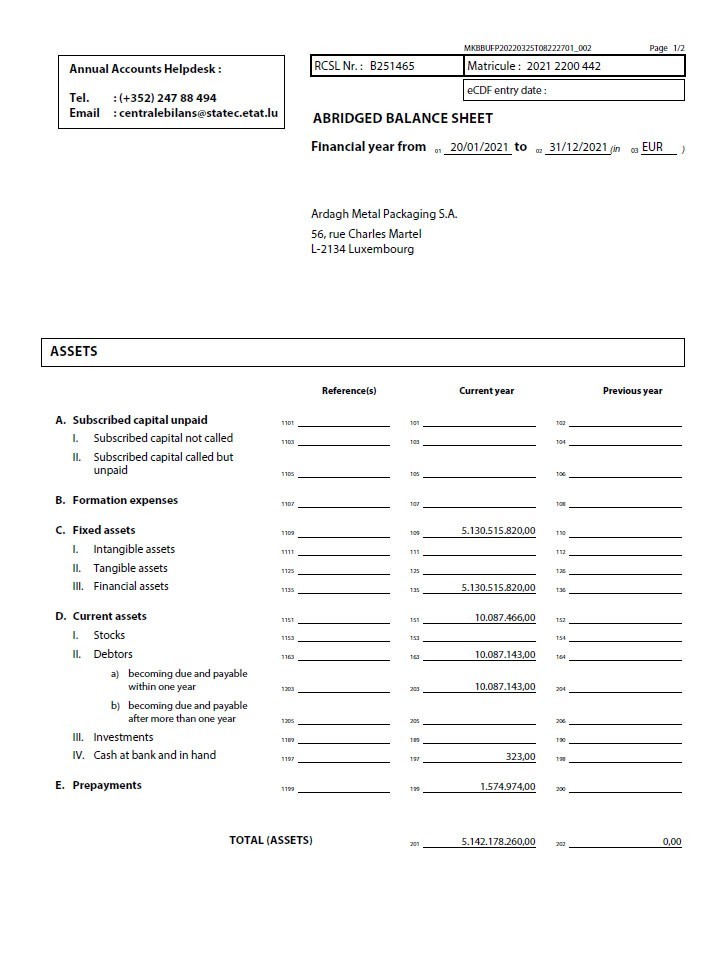

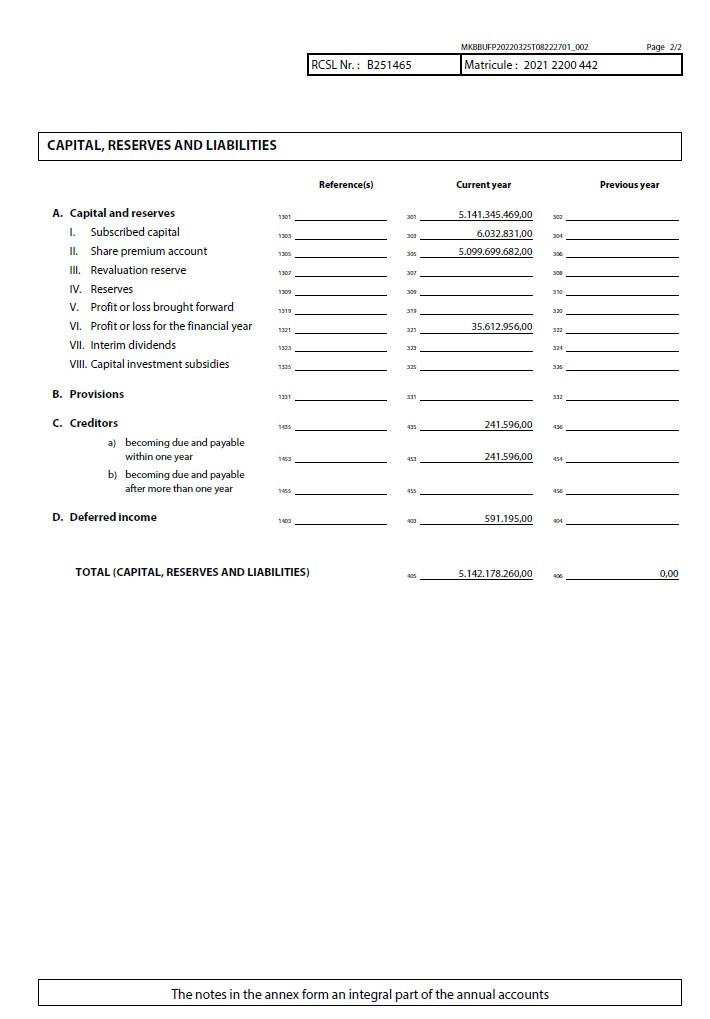

| ● | the abridged balance sheet as at 31 December 2021; |

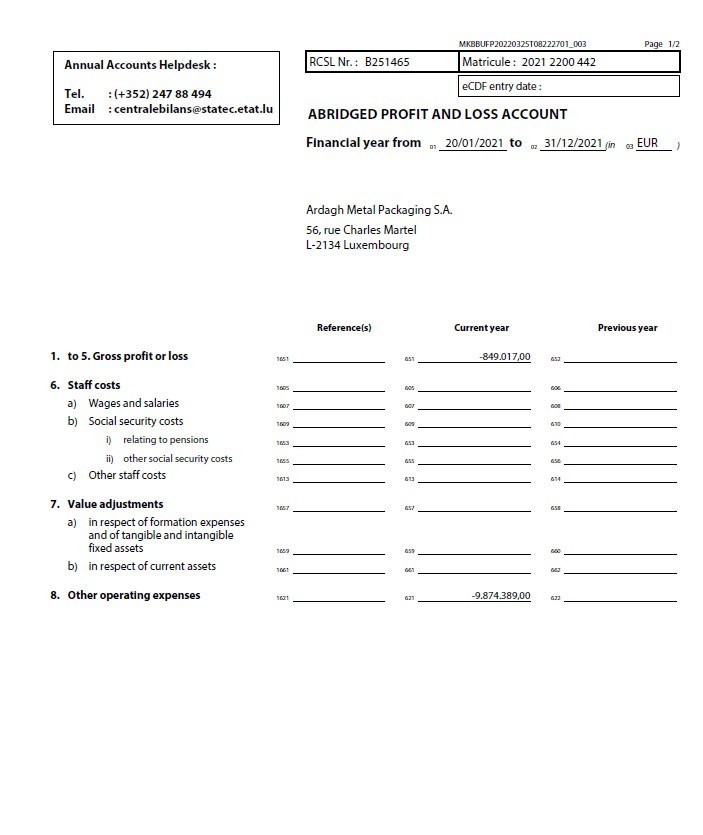

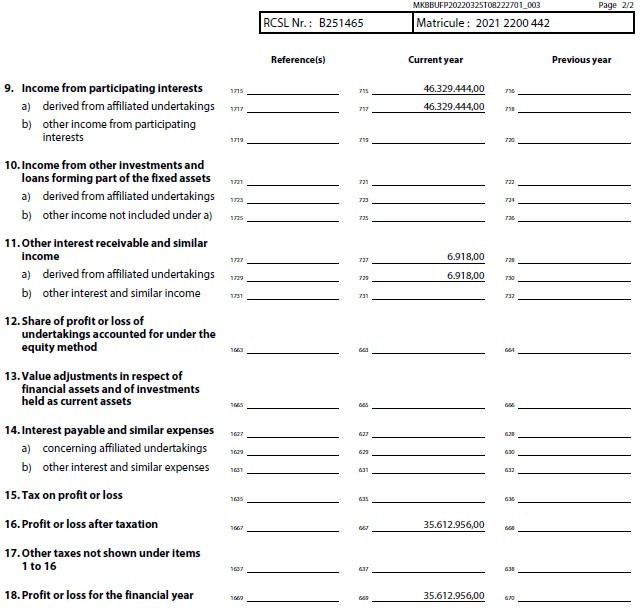

| ● | the abridged profit and loss account for the period from 20 January 2021 (date of incorporation) to 31 December 2021; and |

| ● | the notes to the annual accounts, which include a summary of significant accounting policies. |

Basis for opinion

We conducted our audit in accordance with the Law of 23 July 2016 on the audit profession (Law of 23 July 2016) and with International Standards on Auditing (ISAs) as adopted for Luxembourg by the “Commission de Surveillance du Secteur Financier” (CSSF). Our responsibilities under the Law of 23 July 2016 and ISAs as adopted for Luxembourg by the CSSF are further described in the “Responsibilities of the “Réviseur d’entreprises agréé” for the audit of the annual accounts” section of our report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

We are independent of the Company in accordance with the International Code of Ethics for Professional Accountants, including International Independence Standards, issued by the International Ethics Standards Board for Accountants (IESBA Code) as adopted for Luxembourg by the CSSF together with the ethical requirements that are relevant to our audit of the annual accounts. We have fulfilled our other ethical responsibilities under those ethical requirements.

Other information

The Board of Directors is responsible for the other information. The other information comprises the information stated in the annual report but does not include the annual accounts and our audit report thereon.

Our opinion on the annual accounts does not cover the other information and we do not express any form of assurance conclusion thereon.

PricewaterhouseCoopers, Société coopérative, 2 rue Gerhard Mercator, B.P. 1443, L-1014 Luxembourg T : +352 494848 1, F : +352 494848 2900, www.pwc.lu

Cabinet de révision agréé. Expert-comptable (autorisation gouvernementale n°10028256)

R.C.S. Luxembourg B 65 477 - TVA LU25482518

3

In connection with our audit of the annual accounts, our responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the annual accounts or our knowledge obtained in the audit, or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Responsibilities of the Board of Directors and those charged with governance for the annual accounts

The Board of Directors is responsible for the preparation and fair presentation of the annual accounts in accordance with Luxembourg legal and regulatory requirements relating to the preparation and presentation of the annual accounts, and for such internal control as the Board of Directors determines is necessary to enable the preparation of annual accounts that are free from material misstatement, whether due to fraud or error.

In preparing the annual accounts, the Board of Directors is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the Board of Directors either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting process.

Responsibilities of the “Réviseur d’entreprises agréé” for the audit of the annual accounts

The objectives of our audit are to obtain reasonable assurance about whether the annual accounts as a whole are free from material misstatement, whether due to fraud or error, and to issue an audit report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with the Law of 23 July 2016 and with ISAs as adopted for Luxembourg by the CSSF will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these annual accounts.

As part of an audit in accordance with the Law of 23 July 2016 and with ISAs as adopted for Luxembourg by the CSSF, we exercise professional judgment and maintain professional scepticism throughout the audit. We also:

| ● | identify and assess the risks of material misstatement of the annual accounts, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control; |

| ● | obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control; |

| ● | evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Board of Directors; |

4

| ● | conclude on the appropriateness of the Board of Directors’ use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our audit report to the related disclosures in the annual accounts or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our audit report. However, future events or conditions may cause the Company to cease to continue as a going concern; |

| ● | evaluate the overall presentation, structure and content of the annual accounts, including the disclosures, and whether the annual accounts represent the underlying transactions and events in a manner that achieves fair presentation. |

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and communicate to them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, actions taken to eliminate threats or safeguards applied.

PricewaterhouseCoopers, Société coopérative Represented by

Laurence Demelenne

Luxembourg, 31 March 2022

5

6

7

8

9

Notes to the Audited Annual Accounts

| 1. | General information |

Ardagh Metal Packaging S.A. (the “Company”) is the holding company for the Metal Packaging operations of Ardagh Group. The Company was incorporated in Luxembourg on 20 January 2021. Its registered office is 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg. The Company’s shares trade on the New York Stock Exchange. The immediate parent company of the Company is Ardagh Group S.A.. ARD Holdings S.A. is the ultimate parent company of the Company and of Ardagh Group S.A., the holding company of the Ardagh Group.

The Company’s financial period starts on 20 January 2021 (date of incorporation) and ends on 31 December 2021.

The Company also prepares consolidated financial statements, which are published according to the provisions of Luxembourg law.

On February 22, 2021, Ardagh announced its entry into a business combination agreement (the “Business Combination Agreement”), dated as of February 22, 2021, by and among Ardagh, Ardagh Metal Packaging, Ardagh MP MergeCo Inc., a newly formed Delaware corporation that is a wholly-owned subsidiary of AMP (“MergeCo”) and Gores Holdings V Inc. (“Gores Holdings V”), pursuant to which the parties thereto agreed to effect the merger of MergeCo with and into Gores Holdings V, with Gores Holdings V being the surviving corporation as a wholly-owned subsidiary of AMP (the “Merger”, and, together with the other transactions contemplated in the Business Combination Agreement, the “Business Combination”) to create an independent, pure-play beverage can company.

In connection with the Business Combination, the Ardagh Group effected on April 1, 2021 a series of transactions that resulted in (a) the equity interests of Ardagh Packaging Holdings Limited, an Irish subsidiary of the Group, and certain other subsidiaries of the Ardagh Group that are engaged in the metal beverage can business being directly or indirectly owned by AMPSA (all such entities collectively, the “AMP Entities”) and (b) any assets and liabilities relating to the business of the Ardagh Group (other than the AMP Business) that were held by the AMP Entities being transferred to subsidiaries of the Ardagh Group that are not AMP Entities, and assets and liabilities relating to the AMP Business that were held by subsidiaries of the Ardagh Group (other than the AMP Entities) being transferred to the AMP Entities (such transactions, collectively, the “AMP Transfer”).

On August 4, 2021, in accordance with the terms of the Business Combination Agreement, the parties consummated the Merger and, pursuant to the terms of subscription agreements dated February 22, 2021, among AMPSA, Gores Holdings V and certain investors in a private placement (the “PIPE Investors”), the PIPE Investors subscribed for and purchased shares of AMPSA at a purchase price of $10 per share, for an aggregate cash amount of $695 million (the “PIPE Investment”), which included 9.5 million of shares acquired pursuant to the “back stop” provisions of the subscription agreement entered into by the Gores Holdings V sponsor. In addition, at the closing of the Merger all shares of Gores Holdings V Class A common stock outstanding immediately prior to the effective time of the Merger (after giving effect to any requested stockholder redemptions) were contributed to AMPSA in exchange for newly issued AMPSA shares, and all warrants exercisable for the purchase of shares in Gores Holdings V were converted into warrants exercisable for the purchase of shares in AMPSA at an exercise price of $11.50 over a five-year period after closing of the Merger.

In addition to retaining AMPSA shares constituting approximately 82% AMPSA’s outstanding shares, Ardagh received in the Business Combination (a) $2,315 million in cash paid upon the consummation of the AMP Transfer (which was funded from the proceeds of the AMP Notes Issuance), and (b) approximately $1.0 billion in cash paid upon the consummation of the Merger and the PIPE Investment. Ardagh also has a contingent right to receive up to 60.73 million additional shares in AMPSA (the “Earnout Shares”) upon the achievement of certain stock price hurdles performance measures.

On August 5, 2021, AMPSA listed its shares and warrants on the New York Stock Exchange under the new ticker symbols “AMBP” and “AMBP.WS”, respectively.

10

| 2. | Summary of significant accounting policies |

| 2.1 | Basis of preparation |

The annual accounts are prepared in conformity with the Luxembourg legal and regulatory requirements under the historical cost convention. The accounting policies and valuation rules are, apart from those enforced by the amended Law of 19 December 2002, determined, and implemented by the board of directors.

The preparation of annual accounts requires the use of certain critical accounting estimates. It also requires the board of directors to exercise its judgement in the process of applying the accounting policies. Changes in assumptions may have a significant impact on the annual accounts in the period in which the assumptions changed. The board of directors believe that the underlying assumptions are appropriate and that the annual accounts therefore present the financial position and results fairly.

The Company makes estimates and assumptions that affect the reported amounts of assets and liabilities in the next financial year. Estimates and judgements are continually evaluated and are based on historical experience and other factors, including expectations and future events that are believed to be reasonable under the circumstances.

| 2.2 | Significant accounting policies |

The main valuation rules applied by the Company are the following:

| (a) | Financial assets |

Shares in affiliated undertakings, participating interests and securities held as fixed assets are valued at purchase price including the expenses incidental thereto. Loans to affiliated undertakings are valued at nominal value.

In the case of durable depreciation in value according to the opinion of the board of directors, value adjustments are made in respect of financial fixed assets, so that they are valued at the lower figure to be attributed to them at the balance sheet date. These value adjustments are not continued if the reasons for which the value adjustments were made have ceased to apply.

| (b) | Debtors |

Debtors are valued at their nominal value. They are subject to value adjustments where their recovery is compromised. These value adjustments are not continued if the reasons for which the value adjustments were made have ceased to apply.

| (c) | Foreign currency Translation |

Transactions expressed in currencies other than Euro are translated into Euro at the exchange rate effective at the time of the transaction.

Financial assets expressed in other currencies than Euro are translated at the exchange rate effective at time of transaction. At the balance sheet date, these assets remain translated at historical exchange rates.

Cash at bank and in hand is translated at the exchange rate effective at the balance sheet date. Exchange losses and gains are recorded in the profit and loss account of the year.

Other assets and liabilities are translated separately respectively at the lower or at the higher of the value converted at the historical exchange rate or the value determined on the basis of the exchange rates effective at the balance sheet date. The unrealised exchange losses are recorded in the profit and loss account. The exchange gains are recorded in the profit and loss account at the moment of their realisation whereas unrealised exchange gains are recognised on the balance sheet as deferred income.

Where there is an economic link between an asset and liability, these are valued in total according to the method described above and the net unrealised losses are recorded in the profit and loss account whereas unrealised exchange gains are not recognised.

| (d) | Provision for taxation |

Provision for taxation corresponding to the tax liability estimated by the Company for the financial years for which the tax return has not yet been filed are recorded under the caption “Other creditors – tax authorities”

11

| (e) | Creditors |

Creditors are recorded at their reimbursement value. Where the amount repayable on account is greater than the amount received, the difference is shown as an asset and is written off over the period of the debt based on a linear method.

| (f) | Share premium account |

A share premium account is recorded in the Capital and reserves section of the balance sheet. The share premium account represents the difference between the par value of the shares issued and the issue price.

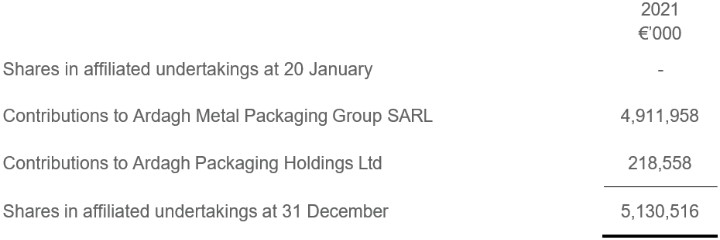

| 3. | Shares in affiliated undertakings |

Shares in affiliated undertakings

The Company’s affiliated undertakings are:

|

|

|

Last |

Net equity |

Loss for the year |

Name |

Registered office |

Ownership |

Balance |

‘000 |

‘000 |

|

|

% |

Sheet date |

Unaudited |

Unaudited |

Ardagh Metal Packaging Group SARL (AMPGS) |

56, rue Charles Martel, L-2134 Luxembourg, Luxembourg |

100% |

31/12/2021 |

€3,178,828* |

(€3,893)* |

Ardagh Packaging Holdings Ltd (APHL) |

Ardagh House South County Dublin Business Park Leopardstown Dublin 18 Ireland |

6.12% |

31/12/2021 |

$667,965* |

($640,720)* |

* These relate to the provisional stand-alone annual accounts of these entities.

The Management of the Company is of the opinion that the recoverable value of the investment is higher than its net book value.

During the year, the Company contributed its investment in Gores Holdings V of € 218,557,891 to APHL in exchange for Class B shares of APHL.

During the year, the Company made contributions to Ardagh Metal Packaging Group S.a.r.l. in the form of its investment in Ardagh Metal Packaging Holdings S.a.r.l. of € 2,907,155,410, cash of $ 695,000,000 and receivables totalling

€1,419,354,808.

12

| 4. | Amounts owed by affiliated undertakings |

Becoming due and payable within one year

This is an interest-bearing, working capital loan denominated in Euro & USD with Ardagh Metal Packaging Treasury Limited. Interest is calculated on the basis of a 360-day year and the actual days elapsed. The loan is repayable on demand.

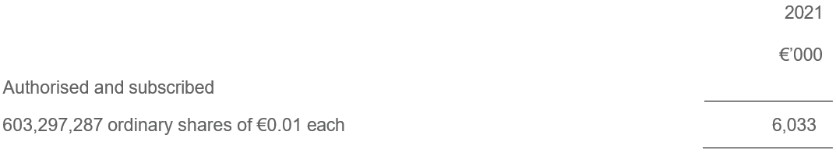

| 5. | Capital and reserves |

Subscribed capital

The movements in the subscribed capital were as follows:

The movements in the reserve accounts are as follows:

On completion of the AMP Transfer on April 1, 2021, AMPSA issued 484,956,250 shares to AGSA with a nominal value of

€0.01 per share, for consideration totalling $4,988 million. During the year ended December 31, 2021, an additional 118,326,847 shares were issued to PIPE investors, SPAC shareholders and sponsors for a total cash considerations of

$695 million and $259 million, respectively, and $88 million to AGSA for the non-cash settlement of the AMP Promissory Note, totalling $1,042 million, offset by $31 million of directly attributable transaction costs related to the issuance of equity reflected in share premium, of which $29 million has been paid as of December 31, 2021.There were no other material share transactions in the year ended December 31, 2021.

13

Legal reserve

Under Luxembourg law, the Company is required to allocate a minimum of 5% of its annual net income to a legal reserve, until this reserve equals 10% of the subscribed share capital. This reserve is not available for distribution.

| 6. | Amounts owed to affiliated undertakings |

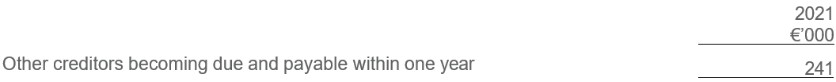

| 7. | Other Creditors |

| 8. | Deferred income |

This amount represents an unrealised exchange gain on a US Dollar loan referenced in Note 4 calculated at the exchange rate effective at the balance sheet date. In accordance with the Foreign Currency accounting policy outlined in 2.2 (c) above, this gain is recognised as deferred income because the gain has not been realised.

| 9. | Other external expenses |

Other external expenses relate to direct and indirect costs and expenses for the operations of the AMP Business.

| 10. | Staff Costs |

This company has no employees.

14

| 11. | Other operating expenses |

Other external expenses relate to costs incurred as a result of the business combination referenced in Note 1.

| 12. | Income from participating interests |

Derived from affiliated undertakings

Income derived from affiliated undertakings relates to dividend income.

| 13. | Other Interest receivable and similar income |

| 14. | Tax on profit or loss |

| 15. | Commitments and contingencies |

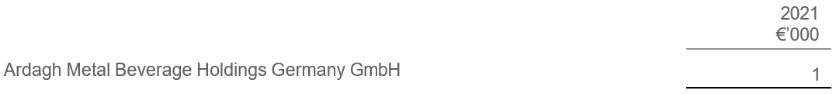

The Company has guaranteed certain liabilities of a number of its subsidiaries for the year ended 31 December 2021 including guarantees under Section 357 of the Irish Companies Act, 2014, and Section 264 of the German Commercial Code, as listed below. Furthermore, the Company has assumed joined and several liability in accordance with Section 403, Book 2 of the Dutch Civil Code for the liabilities of a number of its Dutch subsidiaries, as listed below.

Section 357 Exemption – Irish Company Law Requirement

The Irish subsidiary undertakings of Ardagh Metal Packaging S.A. listed below, which are included in these consolidated financial statements, have availed of an exemption from filing their individual financial statements with the Irish Registrar of Companies as permitted by Section 357 of the Irish Companies Act, 2014 on the basis that they have satisfied the conditions as laid out in Sections 357 (a) to (h) of that Act.

15

Ardagh Packaging Holdings Limited Ardagh Metal Packaging Finance plc Ardagh Metal Packaging Treasury Limited

Section 264 Exemption – German Commercial Code Requirement

The German subsidiary undertakings of Ardagh Metal Packaging S.A. listed below, which are included in these consolidated financial statements, have availed of an exemption from filing their individual financial statements with the German Registrar of Companies as permitted by Section 264 paragraph 3 of the German Commercial Code, on the basis that they have satisfied the conditions as laid out in Section 264 Paragraph 3 Item 1.-5. of that Code.

Ardagh Metal Beverage Holdings Germany GmbH Ardagh Metal Beverage Germany GmbH

Ardagh Metal Beverage Trading Germany GmbH Earnout Shares

As described in note 1 and resulting from the AMP Transfer, AGSA has a contingent right to receive up to 60.73 million Earnout Shares. The Earnout Shares are issuable by AMPSA to AGSA subject to attainment of certain stock price hurdles, with equal amounts of shares at $13, $15, $16.50, $18, and $19.50, respectively, over a five-year period from the 180th day following the closing of the Merger. There have been no triggering events in relation to the earnout shares

and as a result these have been treated as off-balance sheet items. Warrants

As further outlined in note 1, all warrants previously exercisable for the purchase of shares in Gores Holdings V were converted into AMPSA warrants exercisable for the purchase of shares in AMPSA at an exercise price of $11.50 over a five-year period after closing of the Merger. There have been no triggering events in relation to the warrants and as a

result these have been treated as off-balance sheet items. The estimated valuation of the contingent liability as of August 4 and December 31, 2021 were $41 million and $33 million, respectively.

| 16. | Related party transactions |

Except for interest receivable from affiliated entities, and investments in and loans to and from affiliated entities as

disclosed in notes 3, 4, 5, 6, 12 and 13, there were no material related party transactions during the period ended 31 December 2021.

| 17. | Subsequent events |

There have been no significant events between the balance sheet date and the date of approval of the financial statements.

| 18. | Approval of annual accounts |

The board of directors approved these annual accounts on 30 March 2022.

16