EX-99.1

Published on April 12, 2023

Exhibit 99.1

www.ardaghmetalpackaging.com

Ardagh Metal Packaging S.A.

56, rue Charles Martel

L-2134 Luxembourg, Luxembourg

T: +352 26 25 85 - 55

F: +352 26 38 94 - 44

E: enquiries@ardaghgroup.com

April 11, 2023

Dear Shareholder,

You are cordially invited to attend the 2023 annual general meeting of shareholders (the “Annual General Meeting”) of Ardagh Metal Packaging S.A. (the “Company”) to be held on May 16, 2023, at 12:00 p.m. Luxembourg time at 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg. Information concerning the matters to be considered and voted upon at the Annual General Meeting is set out in the attached Convening Notice and Proxy Statement.

The Board of Directors of the Company has fixed March 24, 2023 (10:00 p.m. Luxembourg time, 4:00 p.m. EDT) as the record date for the Annual General Meeting (the “Record Date”), and only holders of record of the ordinary shares at such time will be entitled to vote at the Annual General Meeting or any adjournment or postponement thereof.

If you are unable to attend the Annual General Meeting or you wish to be represented, please authorize a proxy to vote your ordinary shares in accordance with the instructions you have received. This will not prevent you from voting your ordinary shares in person if you subsequently choose to attend our Annual General Meeting.

Please note that powers of attorney or proxy cards must be received by the tabulation agent (Computershare), no later than 6:00 p.m. Luxembourg time, 12:00 p.m. EDT, on May 14, 2023, in order for such votes to be taken into account.

On behalf of the Board of Directors of the Company, we thank you for your continued support.

Sincerely,

Paul Coulson

Chairman

Convening Notice to

the Annual General Meeting of Shareholders

to be held on May 16, 2023, at 12:00 p.m. Luxembourg time

at 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg

April 11, 2023

Dear Shareholder,

The Board of Directors of Ardagh Metal Packaging S.A. (the “Company”) is pleased to invite you to attend the 2023 annual general meeting of shareholders (the “Annual General Meeting”), to be held on May 16, 2023, at 12:00 p.m. Luxembourg time, at 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg with the following agenda:

Agenda of the Annual General Meeting

| 1. | Consider the reports of the Board of Directors of the Company and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s consolidated financial statements for the year ended December 31, 2022 and approve the Company’s consolidated financial statements for the year ended December 31, 2022. |

| 2. | Consider the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s annual accounts for the year ended December 31, 2022 and approve the Company’s annual accounts for the year ended December 31, 2022. |

| 3. | Confirm the distribution of interim dividends approved by the Board of Directors of the Company during the year ended December 31, 2022 and approve carrying forward the results for the year ended December 31, 2022. |

| 4. | Grant discharge (quitus) to all members of the Board of Directors of the Company who were in office during the year ended December 31, 2022, for the proper performance of their duties. |

| 5. | Re-elect the Class II Directors of the Company : |

| ● | Oliver Graham, as a Class II Director until the 2026 annual general meeting of shareholders; |

| ● | Elizabeth Marcellino, as a Class II Director until the 2026 annual general meeting of shareholders; and |

| ● | John Sheehan, as a Class II Director until the 2026 annual general meeting of shareholders. |

| 6. | Approve the aggregate amount of the directors’ remuneration for the year ending December 31, 2023. |

| 7. | Appoint PricewaterhouseCoopers Société coopérative as statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the 2024 annual general meeting of shareholders. |

Pursuant to articles 21 and 22 of the articles of association of the Company and article 430-10 of the Luxembourg Law of 10 August 1915 on commercial companies (as amended), the Annual General Meeting will validly deliberate on its agenda with the quorum requirement of at least one-third (1/3) of the issued share capital corresponding to the issued ordinary shares of the Company, and the resolutions at the Annual General Meeting will be adopted by a simple majority of the votes validly cast.

Any shareholder who holds one or more ordinary share(s) on March 24, 2023, at 10:00 p.m. Luxembourg time, 4:00 p.m. EDT (the “Record Date”) will be admitted to the Annual General Meeting, and may attend the Annual General Meeting and vote, as applicable, in person or by proxy. Any shareholder who holds one or more preferred share(s) on the Record Date may attend the Annual General Meeting in person or be represented by proxy, but cannot vote.

Please consult the Proxy Statement enclosed herewith, and also available on the Company’s website, as to the procedures for attending the Annual General Meeting or to be represented by proxy. Copies of the Company’s consolidated financial statements and its annual accounts for the year ended December 31, 2022, together with the reports of the Board of Directors and the statutory auditor are available at www.ardaghmetalpackaging.com/corporate/investors/agm.

Please note that powers of attorney or proxy cards must be received by the tabulation agent (Computershare), no later than 6:00 p.m. Luxembourg time, 12:00 p.m. EDT, on May 14, 2023, in order for such votes to be taken into account.

Sincerely,

Paul Coulson

Chairman

on behalf of the Board of Directors

ARDAGH METAL PACKAGING S.A.

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 16, 2023

GENERAL INFORMATION

This Proxy Statement is being provided to solicit proxies on behalf of the board of directors (the “Board of Directors”) of Ardagh Metal Packaging S.A. (the “Company,” “we,” “our” or “us”) for use at the 2023 annual general meeting of shareholders (the “Annual General Meeting”) to be held on May 16, 2023, at 12:00 p.m. Luxembourg time at the Company’s registered office, 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg and any adjournment or postponement thereof. This Proxy Statement is available on our website at www.ardaghmetalpackaging.com/corporate/investors/agm, together with the Company’s consolidated financial statements and its annual accounts for the year ended December 31, 2022 and our Annual Report on Form 20-F for the year ended December 31, 2022 (the “Annual Report on Form 20-F”). The Proxy Statement also will be made available to our “street name” holders (meaning beneficial owners with their ordinary shares of the Company (the “Ordinary Shares”) held through a bank, brokerage firm or other record owner) and registered shareholders (which includes the beneficial owners of the preferred shares of the Company (the “Preferred Shares,” and together with the Ordinary Shares, the “Shares”)) as at the Record Date (as defined below) through the delivery methods described below.

This Proxy Statement, together with the Convening Notice containing the agenda and the proxy card with reply envelope, are hereinafter referred to as the “Proxy Materials.”

Foreign Private Issuer

We are a “foreign private issuer” within the meaning of Rule 3b-4 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as a result, we are not required to mandatorily comply with U.S. federal proxy requirements.

How May the Annual General Meeting Materials Be Accessed?

| (a) | Street name holders |

We have elected to provide access to our Proxy Materials over the internet. Accordingly, we are sending a notice (the “Information Notice”) on April 11, 2023, regarding the internet availability of Proxy Materials to our street name holders of record as of 10:00 p.m. Luxembourg time, 4:00 p.m. EDT, on March 24, 2023 (the “Record Date”). You will have the ability to access the Proxy Materials, the Company’s consolidated financial statements and its annual accounts for the year ended December 31, 2022, and our Annual Report on Form 20-F on the website referred to in the Information Notice (www.ardaghmetalpackaging.com/corporate/investors/agm). Street name holders may also request to receive a printed set of the Proxy Materials. Instructions on how to access the Proxy Materials either by viewing them online or by requesting a copy may be found in the Information Notice. You will not receive a printed copy of the Proxy Materials unless you have requested one when setting up your brokerage account or request one in the manner set forth in the Information Notice. This permits us to conserve natural resources and reduces our printing costs, while giving shareholders a convenient and efficient way to access our Proxy Materials and to exercise the voting rights attendant to their Ordinary Shares at the Annual General Meeting.

| (b) | Registered shareholders |

We are mailing the Proxy Materials on April 11, 2023 to all registered shareholders of our Shares as at the Record Date.

Who May Vote at the Annual General Meeting?

Only registered shareholders or street name holders of our Shares as at the Record Date will be entitled to notice of the Annual General Meeting and only registered shareholders or street name holders of our Ordinary Shares will be entitled to vote at the Annual General Meeting. On the Record Date, 597,588,908 Ordinary Shares were issued and outstanding and 56,306,306 Preferred Shares were issued and outstanding. Each ordinary share is entitled to one vote at the Annual General Meeting. The Preferred Shares have no voting rights on the items submitted to the Annual General Meeting.

What Constitutes a Quorum?

At any ordinary general meeting (including the Annual General Meeting), the holders of in excess of one-third (1/3) of the share capital corresponding to the issued Ordinary Shares, who are present in person or represented by proxy will form a quorum for the transaction of business. As the Preferred Shares of the Company do not have any voting rights on the items submitted to the Annual General Meeting, the Preferred Shares will not be taken into account for determining the quorum Abstentions, as described below, are counted as Ordinary Shares present for purposes of determining whether a quorum exists.

What Are Broker Non-Votes and Abstentions?

Broker non-votes occur when brokers holding Ordinary Shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote their Ordinary Shares and the broker is unable to vote the Ordinary Shares in its discretion in the absence of an instruction. An abstention occurs when a shareholder withholds such shareholder’s vote on a particular matter by checking the “ABSTAIN” box on the proxy card.

Your broker will NOT be able to vote your Ordinary Shares with respect to any of the proposals or other matters considered at the Annual General Meeting, unless you have provided instructions to your broker. We strongly encourage you to provide instructions to your broker to vote your Ordinary Shares and exercise your right as a shareholder. A vote will not be cast in cases where a broker has not received an instruction from the beneficial owner.

With respect to all of the proposals or other matters considered at the Annual General Meeting, only those votes cast “FOR” or “AGAINST” are counted for the purposes of determining the number of votes cast with respect to each such proposal.

Broker non-votes and abstentions are not considered votes cast and have no effect on the outcome of any of the proposals.

What Is the Process for Voting and Revocation of Proxies?

If you are a registered shareholder holding Ordinary Shares, you can vote by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope. Submitting your proxy by mail will not affect your ability to attend the Annual General Meeting in person and to vote at the Annual General Meeting.

2

If your Ordinary Shares are held in “street name”, you will receive instructions from your bank, brokerage firm or other record owner. You must follow the instructions of the bank, brokerage firm or other record owner in order for your Ordinary Shares to be voted on your behalf.

The Company will retain an independent tabulator to receive and tabulate the proxies.

If you submit a proxy and direct how your Ordinary Shares will be voted, the individuals named as proxies will vote your Ordinary Shares in the manner you indicate. If you submit a proxy but do not direct how your Ordinary Shares will be voted, the individuals named as proxies will vote your Ordinary Shares “FOR” the re-election of each of the nominees for director and “FOR” each of the other proposals identified herein.

It is not expected that any other matters will be brought before the Annual General Meeting. If, however, other matters are properly presented, the individuals named as proxies will vote in accordance with their discretion with respect to such matters.

A registered shareholder holding Ordinary Shares who has given a proxy may revoke it at any time before it is exercised at the Annual General Meeting by:

| ● | attending the Annual General Meeting and voting in person; |

| ● | delivering a written notice on or before May 14, 2023, at 6:00 p.m. Luxembourg time, 12:00 p.m. EDT at the address given below, stating that the previously delivered proxy is revoked; or |

| ● | signing and delivering on or before May 14, 2023, at 6:00 p.m. Luxembourg time, 12:00 p.m. EDT to the address given below a subsequently dated proxy card dated prior to the vote at the Annual General Meeting. |

If you are a registered shareholder holding Ordinary Shares, you may request a new proxy card by calling the Company at its registered office in Luxembourg at +352 26 25 85 55.

Registered shareholders holding Ordinary Shares should send any written notice or proxy card by (i) regular mail to Ardagh Metal Packaging S.A., c/o Computershare, PO Box 43101, Providence, RI 02940-5067, or (ii) by courier or U.S. overnight mail to Ardagh Metal Packaging S.A., c/o Computershare, 150 Royall Street, Suite 101, Canton, MA 02021 (Telephone: 1800-736-3001 and from outside the US +1 781 575 3100).

Any street name holder of Ordinary Shares may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the Ordinary Shares or by obtaining a legal proxy from such bank or brokerage firm and voting in person at the Annual General Meeting. Your last voting instructions, prior to or at the Annual General Meeting, are the voting instructions that will be taken into account.

Who May Attend the Annual General Meeting?

Only holders of our shares as at the Record Date or their legal proxy holders may attend the Annual General Meeting. All holders of our shares planning to attend the Annual General Meeting in person must contact our Assistant Company Secretary, Cindy Cooper, at +352 26 25 85 55 or cindy.cooper@ardaghgroup.com by May 14, 2023 to reserve a seat. For admission, shareholders should

3

arrive at the Annual General Meeting check-in area no less than 15 minutes before the Annual General Meeting is scheduled to begin.

| ● | Registered shareholders |

To be admitted to the Annual General Meeting, you will need a form of photo identification. You will be admitted to the Annual General Meeting only if we are able to verify your shareholder status by checking your name against the list of registered shareholders on the Record Date.

| ● | Street name holders |

To be admitted to the Annual General Meeting, you will need a form of photo identification and you must also bring valid proof of ownership of your Ordinary Shares on the Record Date; in order to vote at the Annual General Meeting, you must bring a valid legal proxy from the holder of record.

If you hold your Ordinary Shares in street name through a bank or brokerage firm, a brokerage statement reflecting your ownership as at the Record Date or a letter from a bank or broker confirming your ownership as at the Record Date is sufficient proof of ownership to be admitted to the Annual General Meeting.

Registration will begin on May 16, 2023, at 11:30 a.m. Luxembourg time and the Annual General Meeting will begin on May 16, 2023, at 12:00 p.m. Luxembourg time.

No cameras, recording equipment, electronic devices (including cell phones) or large bags, briefcases or packages will be permitted at the Annual General Meeting.

Certain members of the Board of Directors will attend the Annual General Meeting.

What Is the Process for the Solicitation of Proxies?

We will pay the cost of soliciting proxies for the Annual General Meeting. We may solicit by mail, telephone, personal contact and electronic means and arrangements are made with brokerage houses and other custodians, nominees and fiduciaries to send the Information Notice, and if requested, Proxy Materials, to beneficial owners. Upon request, we will reimburse them for their reasonable expenses. In addition, our directors, officers and employees may solicit proxies, either in person or by telephone, facsimile or written or electronic mail (without additional compensation). Shareholders are encouraged to return their proxies promptly.

4

PROPOSAL WITH RESPECT TO AGENDA ITEMS NO. 1 AND 2:

APPROVAL OF CONSOLIDATED FINANCIAL STATEMENTS AND ANNUAL ACCOUNTS

At the Annual General Meeting, the Board of Directors will present the report on conflicts of interest, the management report on the Company’s consolidated financial statements, as well as the reports of the statutory auditor (réviseur d’entreprises agréé) on the consolidated financial statements and the annual accounts for the year ended December 31, 2022. The management report and the statutory auditor’s reports are available on our website at www.ardaghmetalpackaging.com/corporate/investors/agm. After such presentation, the following resolutions will be put before the Annual General Meeting for approval:

RESOLVED: The Annual General Meeting, after having reviewed the report of the Board of Directors and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s consolidated financial statements for the year ended December 31, 2022, hereby approves the consolidated financial statements of the Company for the year ended December 31, 2022 in their entirety.

RESOLVED: The Annual General Meeting, after having reviewed the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s annual accounts for the year ended December 31, 2022, hereby approves the annual accounts of the Company for the year ended December 31, 2022 in their entirety.

Vote Required and Recommendation of the Board of Directors

Approval of these proposals requires the affirmative vote of a simple majority of votes validly cast on such resolution by shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolutions will fail.

Our Board of Directors recommends a vote “FOR” the approval of the Company’s consolidated financial statements and its annual accounts for the year ended December 31, 2022.

5

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 3:

APPROVAL OF ALLOCATION OF ANNUAL RESULTS

The Board of Directors will propose to the Annual General Meeting (1) to confirm the distribution of interim dividends which have been made in respect of the year ended December 31, 2022, being:

| (i) | the amount of $60,330,806 which was distributed as an interim dividend ($0.10 per ordinary share) on June 28, 2022 (as the 2022 first quarter dividend); |

| (ii) | the amount of $60,330,806 which was distributed as an interim dividend ($0.10 per ordinary share) on June 28, 2022 (as the 2022 second quarter dividend); |

| (iii) | the amount of $59,756,285 which was distributed as an interim dividend ($0.10 per ordinary share) and of €5,624,999.97 which was distributed as interim dividend (€0.0999 per preferred share) on October 27, 2022 (as the 2022 third quarter dividend); and |

| (iv) | the amount of $59,756,285 which was distributed as an interim dividend ($0.10 per ordinary share) and of €5,624,999.97 which was distributed as interim dividend (€0.0999 per preferred share) on November 28, 2022 (as the 2022 fourth quarter dividend); and |

(2) to approve carrying forward the results for the year ended December 31, 2022.

RESOLVED: The Annual General Meeting hereby (1) confirms the distribution of interim dividends which have been made in respect of the year ended December 31, 2022, being (i) the amount of $60,330,806 which was distributed as an interim dividend ($0.10 per ordinary share) on June 28, 2022 (as a 2022 first quarter dividend), (ii) the amount of $60,330,806 which was distributed as an interim dividend ($0.10 per ordinary share) on June 28, 2022 (as a 2022 second quarter dividend), (iii) the amount of $59,756,285 which was distributed as an interim dividend ($0.10 per ordinary share) and the amount of €5,624,999.97 which was distributed as an interim dividend (€0.0999 per preferred share) on October 27, 2022 (as a 2022 third quarter dividend), and (iv) the amount of $59,756,285 which was distributed as an interim dividend ($0.10 per ordinary share) and the amount of €5,624,999.97 which was distributed as an interim dividend (€0.0999 per preferred share) on November 28, 2022 (as a 2022 fourth quarter dividend), all such distributions being made out of the available reserves of the Company, and (2) approves carrying forward the results for the year ended December 31, 2022 as recommended by the Board of Directors.

Vote Required and Recommendation of the Board of Directors

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the approval of the allocation of our annual results.

6

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 4:

APPROVAL OF DISCHARGE TO DIRECTORS FOR PERFORMANCE

Under Luxembourg law, the shareholders are asked to vote on the discharge (quitus) of the directors with respect to the performance of their duties during the year ended December 31, 2022. At the Annual General Meeting, the shareholders will be asked to approve the following resolution with respect to the discharge of our directors who served during the year ended December 31, 2022:

RESOLVED: The Annual General Meeting hereby grants discharge (quitus) to the members of the Board of Directors who were in office during the year ended December 31, 2022 for the proper performance of their duties.

Vote Required and Recommendation of the Board of Directors

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the approval of discharge to the members of the Board of Directors.

7

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 5:

RE-ELECTION OF CLASS II DIRECTORS OF THE COMPANY

Our Board of Directors consists of ten (10) directors. The articles of association of the Company (the “Articles of Association”) provide that our Board of Directors will consist of no fewer than three (3) directors and no more than fifteen (15) directors, with the number of directors within that range being determined by the Board of Directors from time to time. Pursuant to our Articles of Association, our directors are appointed by the annual general meeting of shareholders for a period of one to three years.

The Board of Directors has nominated Oliver Graham, Elizabeth Marcellino and John Sheehan for re-election as directors of the Company as Class II Directors, with each of their terms of office expiring at the annual general meeting of shareholders to be held in 2026. All nominees are presently members of the Board of Directors.

As provided in the Articles of Association, except in the case of a vacancy in the office of director filled by the Board of Directors as described therein, the Company may elect directors by resolution adopted at an ordinary general meeting of shareholders (including an annual general meeting of shareholders).

Nominees for Re-election to the Board of Directors

Information concerning the nominees for re-election to the Board of Directors is set forth below:

Name |

Age |

Position |

Independent |

|---|---|---|---|

Oliver Graham |

55 |

Chief Executive Officer and Director |

|

Elizabeth Marcellino |

65 |

Director |

⌧ |

John Sheehan |

57 |

Director |

|

Oliver Graham is CEO of Ardagh Metal Packaging S.A., a position he has held since 2020. Before taking up this role, Mr. Graham was CEO of Metal Packaging Europe with responsibility for Metal Packaging Brazil, as well as being Ardagh Group S.A. Commercial Director. He joined Ardagh in 2016 following the acquisition of the metal beverage packaging business, prior to which he was Group Commercial Director at Rexam PLC. Mr. Graham joined Rexam PLC in 2013 from The Boston Consulting Group, where he was a partner. He is a British citizen.

Elizabeth Marcellino is a writer and communications consultant who worked for more than a decade as a journalist reporting on a wide range of policy issues for Los Angeles-based City News Service. She was previously a managing director of Goldman Sachs Group, Inc., where she worked from 1991 to 2004 in investment banking, portfolio management, and private equity, with a focus on the real estate industry. Ms. Marcellino serves as a member of the board of directors of Gores Holdings IX and sits on the national board of Jumpstart for Young Children, a nonprofit organization. She earned a B.A. in Economics from the University of California, Los Angeles and an M.B.A. in Finance and Real Estate from The Wharton School of the University of Pennsylvania. Ms. Marcellino is an independent director and is a member of the Audit Committee and the Sustainability Committee. She is a citizen of the United States of America.

John Sheehan was appointed Chief Financial Officer and Director of Ardagh Group in 2021, having previously been Director of Corporate Development and Investor Relations. Prior to joining Ardagh in 2012, Mr. Sheehan spent twelve years in the equity capital markets with Investec, RBS and

8

NCB, covering a range of industry sectors, including packaging. Mr. Sheehan qualified as a Chartered Accountant with PricewaterhouseCoopers and is a citizen of the Republic of Ireland.

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

RESOLVED: The Annual General Meeting hereby approves the re-election of Oliver Graham, Elizabeth Marcellino and John Sheehan, each as a Class II Director of the Company for a term ending at the Company’s 2026 annual general meeting of shareholders.

Vote Required and Recommendation of the Board of Directors

The re-election of each nominee for director requires the affirmative vote of a simple majority of votes validly cast on such matter by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the re-election of the three directors named above to terms of office expiring at the 2026 annual general meeting of shareholders.

9

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 6:

APPROVAL OF THE AGGREGATE AMOUNT OF THE DIRECTORS’ REMUNERATION

We have established a compensation program for our directors that are not employed by the Company or any of its affiliates (our “non-employee directors”) for their service on the Board of Directors and any of its committees. The aggregate amount of our non-employee directors’ compensation as proposed by the Board of Directors for the year ending December 31, 2023 is approximately $1,605,000.

The non-employee directors’ compensation program will allow each non-employee director the opportunity to elect to receive Ordinary Shares in lieu of a portion of the annual cash retainer payable to the non-employee director under the program. We also reimburse our non-employee directors for reasonable out-of-pocket expenses incurred in connection with the performance of their duties as directors, including, without limitation, travel expenses in connection with their attendance in person at Board of Directors and committee meetings. Directors who are employees do not receive any compensation for their services as directors.

We refer to the arrangements described above as the “Remuneration Arrangements.”

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

RESOLVED: The Annual General Meeting hereby approves the Remuneration Arrangements with respect to the non-employee directors of the Company for the year ending December 31, 2023.

Vote Required and Recommendation of the Board of Directors

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the approval of the non-employee directors’ remuneration for the year ending December 31, 2023.

10

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 7:

APPROVAL OF APPOINTMENT OF STATUTORY AUDITOR

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

RESOLVED: The Annual General Meeting hereby approves the appointment of PricewaterhouseCoopers Société coopérative as approved statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the 2024 annual general meeting of shareholders.

Vote Required and Recommendation of the Board of Directors

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting. In the case of an equality of votes the resolution will fail.

Our Board of Directors recommends a vote “FOR” the appointment of PricewaterhouseCoopers Société coopérative as approved statutory auditor (réviseurs d’entreprises agréé) for the period ending at the 2024 annual general meeting of shareholders.

11

CORPORATE GOVERNANCE

Board of Directors

Composition of Our Board of Directors

Our Board of Directors currently consists of ten (10) members divided into three classes, of which seven (7) directors have been deemed by it to be “independent” as set forth under the corporate governance standards of the New York Stock Exchange (the “NYSE Standards”). Our Board of Directors consists of such number of directors as the general meeting of shareholders may from time to time determine, provided that the Board of Directors is composed at all times of no fewer than three (3) directors and no more than fifteen (15) directors. For further information concerning our officers, directors and senior management, please see “Item 6. Directors, Senior Management and Employees—A. Directors and Officers” in our Annual Report on Form 20-F.

Election of Directors

The holders of our Ordinary Shares have the right to elect the Board of Directors at a general meeting of shareholders by a simple majority of the votes validly cast. The existing directors have the right to appoint persons to fill vacancies, which persons may hold office until the next following annual general meeting of shareholders.

Our Board of Directors is classified into three classes of directors. Our current Class I Directors are Yves Elsen, Damien O’Brien, and Hermanus Troskie, with each of their terms of office expiring at the Company’s 2025 annual general meeting of shareholders. Our current Class II Directors are Oliver Graham, Elizabeth Marcellino and John Sheehan, with each of their terms of office expiring on the date of this Annual General Meeting. Each of the Class II Directors has been nominated for re-election at the Annual General Meeting, each for a term of office expiring at the Company’s 2026 annual general meeting of shareholders. Our current Class III Directors are Paul Coulson, Abigail Blunt, The Rt. Hon. the Lord Hammond of Runnymede and Edward White, with each of their terms of office expiring at the Company’s 2024 annual general meeting of shareholders.

Experience of Directors

We believe that the composition of the Board of Directors, which includes a broad spread of nationalities, backgrounds and expertise, provides the breadth and depth of skills, knowledge and experience that are required to effectively lead an internationally diverse business with interests spanning three continents and nine countries.

We believe that our non-employee directors have broad-based international business expertise and have gained significant and relevant industry specific expertise over a number of years. The composition of the Board of Directors reflects the need to maintain a balance of skills, knowledge and experience, including in areas such as sustainability and information technology.

The non-employee directors use their broad-based skills, diverse range of business and financial experiences and international backgrounds in reviewing and assessing any opportunities or challenges facing the Company and play an important role in developing the Company’s strategy and scrutinizing the performance of management in meeting the Company’s goals and objectives.

We expect our Board members collectively to have the experience, qualifications, attributes and skills to effectively oversee the management of the Company, including a high degree of personal and

12

professional integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing the Company, a willingness to devote the necessary time to fulfil their duties to the Board of Directors, a commitment to representing the best interests of the Company and a dedication to enhancing shareholder value.

Committees of the Board of Directors

Our Board of Directors has six standing committees: an executive committee, an audit committee (the “Audit Committee”), a compensation committee (the “Compensation Committee”), a nominating and governance committee (the “Nominating and Governance Committee”), a finance committee and a sustainability committee. The members of each committee are appointed by the Board of Directors and serve until their successors are elected, unless they are earlier removed or they resign. Each of the committees reports to the Board of Directors at least on a quarterly basis, or as frequently as it deems appropriate and as the Board of Directors may request. For further information concerning the composition, duties and responsibilities of each of the committees, please see “Item 6. Directors, Senior Management and Employees—C. Board Practices” in our Annual Report on Form 20-F. In the future, our Board of Directors may establish other committees, as it deems appropriate, to assist it with its responsibilities. The charter for each committee is publicly available on our website at www.ardaghmetalpackaging.com/corporate/investors/governance. The contents of the website are not incorporated by reference into this document.

Foreign Private Issuer and Controlled Company Status

We are a société anonyme incorporated in Luxembourg and our Ordinary Shares are listed on the New York Stock Exchange (“NYSE”). We are therefore required to comply with certain U.S. securities laws and regulations, including the Sarbanes-Oxley Act and the NYSE Standards applicable to listed companies. As a “foreign private issuer” as defined under applicable U.S. securities laws, under the NYSE Standards, we are permitted to follow the corporate governance practices of our home country in lieu of certain provisions of the NYSE Standards. Our intention is to voluntarily comply with these requirements, and as a result, there are currently no significant differences under the NYSE Standards between our corporate governance practices and those of U.S. domestic issuers listed on the NYSE. However, we avail ourselves of certain exemptions afforded to foreign private issuers under the Exchange Act that regulate certain disclosure obligations and procedural requirements, such as the proxy rule exemptions.

We also qualify for and avail ourselves of certain of the controlled company exemptions under the NYSE Standards applicable to listed companies (both foreign private issuers and U.S. domestic issuers) as described in the NYSE Listed Company Manual.

As a controlled company, we are not required to comply with the following requirements:

| ● | a majority of the Board of Directors consist of independent directors; |

| ● | the nominating and governance committee be composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| ● | the compensation committee be composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| ● | there be an annual performance evaluation of the nominating and corporate governance and compensation committees. |

13

Our intention is to voluntarily comply with certain of these requirements, and as a result, the majority of our Board of Directors consists of independent directors, and we have written charters for and conduct annual performance evaluations of our Nominating and Governance Committee and Compensation Committee. However, we currently avail ourselves of the exemption that allows our Nominating and Governance Committee and Compensation Committee not to be composed entirely of independent directors, and there can be no assurance that we will not avail ourselves of other controlled company exemptions in the future.

Due to our status as a foreign private issuer and a controlled company, we may cease voluntary compliance with the requirements that we are exempt from at any time, and you may not have the same protections afford to shareholders of U.S. domestic issuers listed on the NYSE.

The controlled company exemptions do not modify the independence requirements for the Audit Committee, which requires it to be composed of at least three members, each of whom is “independent,” as set forth under the NYSE Standards and the U.S. Securities and Exchange Commission (the “SEC”) rules governing audit committee member independence. All of the members of our Audit Committee are considered independent directors, in accordance with the NYSE Standards and the SEC rules.

For a list of our major shareholders and information relating to their ownership of our Ordinary Shares, please see “Item 7. Major Shareholders and Related Party Transactions—A. Major shareholders” in our Annual Report on Form 20-F.

Code of Conduct

Our Board of Directors has adopted a code of conduct (the “Code”) that establishes the standards of ethical conduct applicable to all of our directors, officers, employees, and third parties working on our behalf. The Code addresses, among other things, competition and fair dealing, conflicts of interest, financial matters and external reporting, compliance with applicable governmental laws, rules and regulations, company funds and assets, and confidentiality requirements and the process for reporting violations of the Code, employee misconduct, conflicts of interest or other violations. Any waiver of the Code with respect to any director or executive officer will be promptly disclosed and posted on our website. Amendments to the Code will be promptly disclosed and posted on our website. The Code is publicly available on our website at www.ardaghmetalpackaging.com/corporate/investors/governance and in print to any shareholder who requests a copy. The contents of the website are not incorporated by reference into this document.

Corporate Governance Guidelines

Our Board of Directors has adopted corporate governance guidelines that serve as a framework within which our Board of Directors and its committees operate. These guidelines cover a number of areas, including the composition of the Board of Directors, membership criteria and director qualifications, director responsibilities, board agenda, roles of the chairman of the Board of Directors and the chief executive officer, meetings of independent directors, access of the Board of Directors to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning. Our Nominating and Governance Committee reviews our corporate governance guidelines periodically and, if necessary, recommends changes to our Board of Directors. Additionally, our Board of Directors has adopted independence standards as part of our corporate governance guidelines. A copy of our corporate governance guidelines is posted on our website at www.ardaghmetalpackaging.com/corporate/investors/governance. The contents of the website are not incorporated by reference into this document.

14

SHAREHOLDER COMMUNICATIONS

Shareholders and interested parties may contact any of the Company’s directors, including the Chairman, the non-employee directors as a group, the chair of any committee of the Board of Directors or any committee of the Board by writing to them as follows:

Ardagh Metal Packaging S.A.

56, rue Charles Martel

L-2134 Luxembourg, Luxembourg

Attn: Company Secretary

Concerns relating to accounting, internal controls or auditing matters should be communicated to the Company through the Company Secretary and will be handled in accordance with the procedures established by the Audit Committee with respect to such matters.

PROPOSALS OF SHAREHOLDERS

Shareholders who together hold at least ten percent (10%) of the share capital and intend to have an item added to the agenda of the Annual General Meeting must comply with the requirements contained in article 19.2 of our Articles of Association. We reserve the right (subject to Luxembourg law) to reject, rule out of order or take other appropriate action with respect to any proposal or nomination that does not comply with these and other applicable requirements.

WHERE YOU CAN FIND MORE INFORMATION

The Company files annual and special reports and other information with the SEC. The Company’s SEC filings are available to the public on the SEC’s internet website at www.sec.gov. In addition, the Company’s SEC filings are also available to the public on the Company’s website, www.ardaghmetalpackaging.com. Information contained on the Company’s website is not incorporated by reference into this document, and you should not consider information contained on that website as part of this document.

15

Important Notice Regarding the Availability of Proxy Materials for the

2023 Annual General Meeting of Shareholders to be held on May 16, 2023

Information is now available regarding the 2023 annual general meeting of shareholders (the “Annual General Meeting”) at www.ardaghmetalpackaging.com/corporate/investors/agm.

YOUR VOTE IS IMPORTANT. OUR BOARD OF DIRECTORS URGES YOU TO

VOTE BY MARKING, DATING, SIGNING AND RETURNING A PROXY CARD.

With respect to all of the proposals and matters considered at the Annual General Meeting, Ordinary Shares held through a broker or other intermediary will not be voted unless the beneficial owner notifies the broker or other intermediary through which the Ordinary Shares are held with instructions regarding how to vote. We strongly encourage you to provide instructions to your broker or other intermediary to vote your Ordinary Shares and exercise your right as a shareholder.

If you wish to attend the Annual General Meeting in person, you must reserve your seat by May 14, 2023 by contacting our Assistant Company Secretary, Cindy Cooper, at +352 26 25 85 55 or cindy.cooper@ardaghgroup.com. Additional details regarding requirements for admission to the Annual General Meeting are described in the Proxy Statement under the heading “Who May Attend the Annual General Meeting?”

If you are a holder of record of our shares as at the Record Date, you will be admitted to the meeting upon presenting a form of photo identification. If you own Ordinary Shares beneficially through a bank, broker or otherwise, you will be admitted to the Annual General Meeting upon presenting a form of photo identification and proof of share ownership as at the Record Date; in order to vote at the Annual General Meeting you must bring a valid legal proxy signed by the record holder. A recent brokerage statement reflecting your ownership as at March 24, 2023 at 10:00 p.m. Luxembourg time, 4:00 p.m. EDT (the “Record Date”) or a letter from a bank or broker confirming your ownership as at the Record Date are examples of proof of share ownership for purposes of admission to the Annual General Meeting. If you are a holder of Ordinary Shares as at the Record Date, you will be entitled to vote at the Annual General Meeting or any adjournment or postponement thereof.

Regardless of whether or not you plan to attend the Annual General Meeting, please follow the instructions you received to authorize a proxy to vote your Ordinary Shares as soon as possible to ensure that your Ordinary Shares are represented at the Annual General Meeting. Any shareholder that decides to attend the Annual General Meeting in person may, if so desired, revoke the prior proxy by voting such person’s Ordinary Shares at the Annual General Meeting as further described in the Proxy Statement under the heading “What Is the Process for Voting and Revocation of Proxies?”

Luxembourg

April 11, 2023

16

|

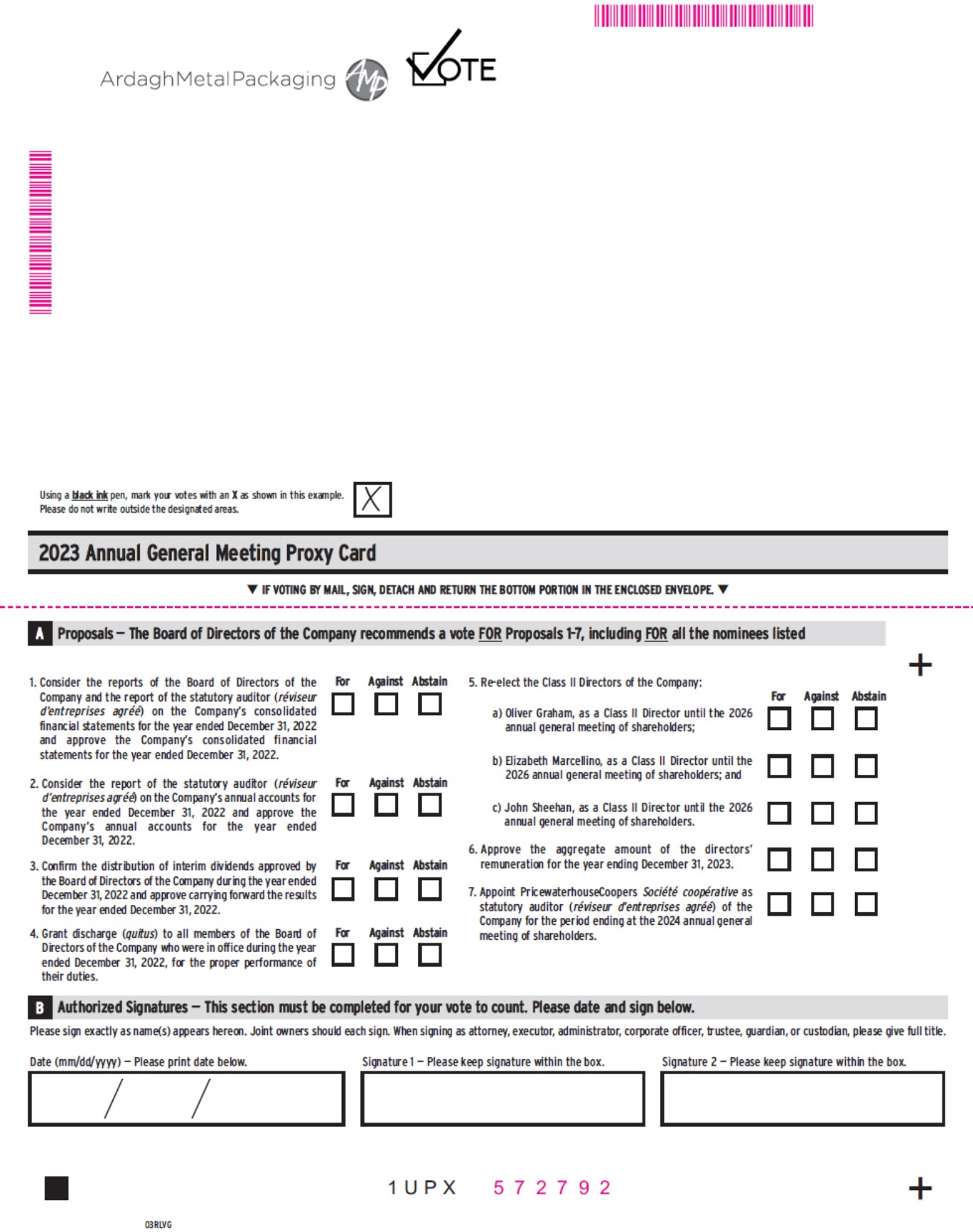

1UPX a) Oliver Graham, as a Class II Director until the 2026 annual general meeting of shareholders; b) Elizabeth Marcellino, as a Class II Director until the 2026 annual general meeting of shareholders; and c) John Sheehan, as a Class II Director until the 2026 annual general meeting of shareholders. For Against Abstain Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. 03RLVG + + q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q 2023 Annual General Meeting Proxy Card Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. B Authorized Signatures — This section must be completed for your vote to count. Please date and sign below. 1. Consider the reports of the Board of Directors of the Company and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s consolidated financial statements for the year ended December 31, 2022 and approve the Company’s consolidated financial statements for the year ended December 31, 2022. 6. Approve the aggregate amount of the directors’ remuneration for the year ending December 31, 2023. For Against Abstain 5. Re-elect the Class II Directors of the Company: 2. Consider the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s annual accounts for the year ended December 31, 2022 and approve the Company’s annual accounts for the year ended December 31, 2022. 7. Appoint PricewaterhouseCoopers Société coopérative as statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the 2024 annual general meeting of shareholders. 3. Confirm the distribution of interim dividends approved by the Board of Directors of the Company during the year ended December 31, 2022 and approve carrying forward the results for the year ended December 31, 2022. For Against Abstain For Against Abstain 4. Grant discharge (quitus) to all members of the Board of Directors of the Company who were in office during the year ended December 31, 2022, for the proper performance of their duties. For Against Abstain A Proposals — The Board of Directors of the Company recommends a vote FOR Proposals 1-7, including FOR all the nominees listed MMMMMMMMM 572792 MMMMMMMMMMMM |

|

This proxy is solicited by the Board of Directors of the Company for use at Ardagh Metal Packaging S.A.’s Annual General Meeting of Shareholders on May 16, 2023 or any postponement(s) or adjournment(s) thereof. The undersigned, having read the Convening Notice and Proxy Statement, dated April 11, 2023, receipt of which is acknowledged hereby, does hereby appoint Paul Coulson, Oliver Graham, John Sheehan and Hermanus Troskie, and each of them, proxies and attorneys-in-fact, each with full power of substitution, for and in the name of the undersigned, to vote and act at the Annual General Meeting of the Shareholders (the "Annual General Meeting") of Ardagh Metal Packaging S.A. (the "Company") to be held at 12:00 p.m. Luxembourg time on May 16, 2023 at the Company's registered office, 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg, and at any postponement(s) or adjournment(s) thereof, with respect to all of the ordinary shares of the undersigned, standing in the name of the undersigned or with respect to which the undersigned is entitled to vote or act at the Annual General Meeting, with all of the powers that the undersigned would possess if personally present and acting as set forth on the reverse side hereof. This proxy, when properly executed and returned in a timely manner, will be voted in the manner directed on the reverse side hereof. If you submit a proxy but do not direct how your shares will be voted, the individuals named as proxies will vote your shares "FOR" the election of each of the nominees for director and "FOR" each of the other proposals identified herein. It is not expected that any other matters will be brought before the Annual General Meeting. If, however, other matters are properly presented, the individuals named as proxies will note in accordance with their discretion with respect to such matters. (Items to be voted appear on reverse side.) Proxy - Ardagh Metal Packaging S.A. q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on May 16, 2023: Information is now available regarding the 2023 Annual General Meeting of Shareholders at https://www.ardaghmetalpackaging.com/corporate/investors/agm. |

|

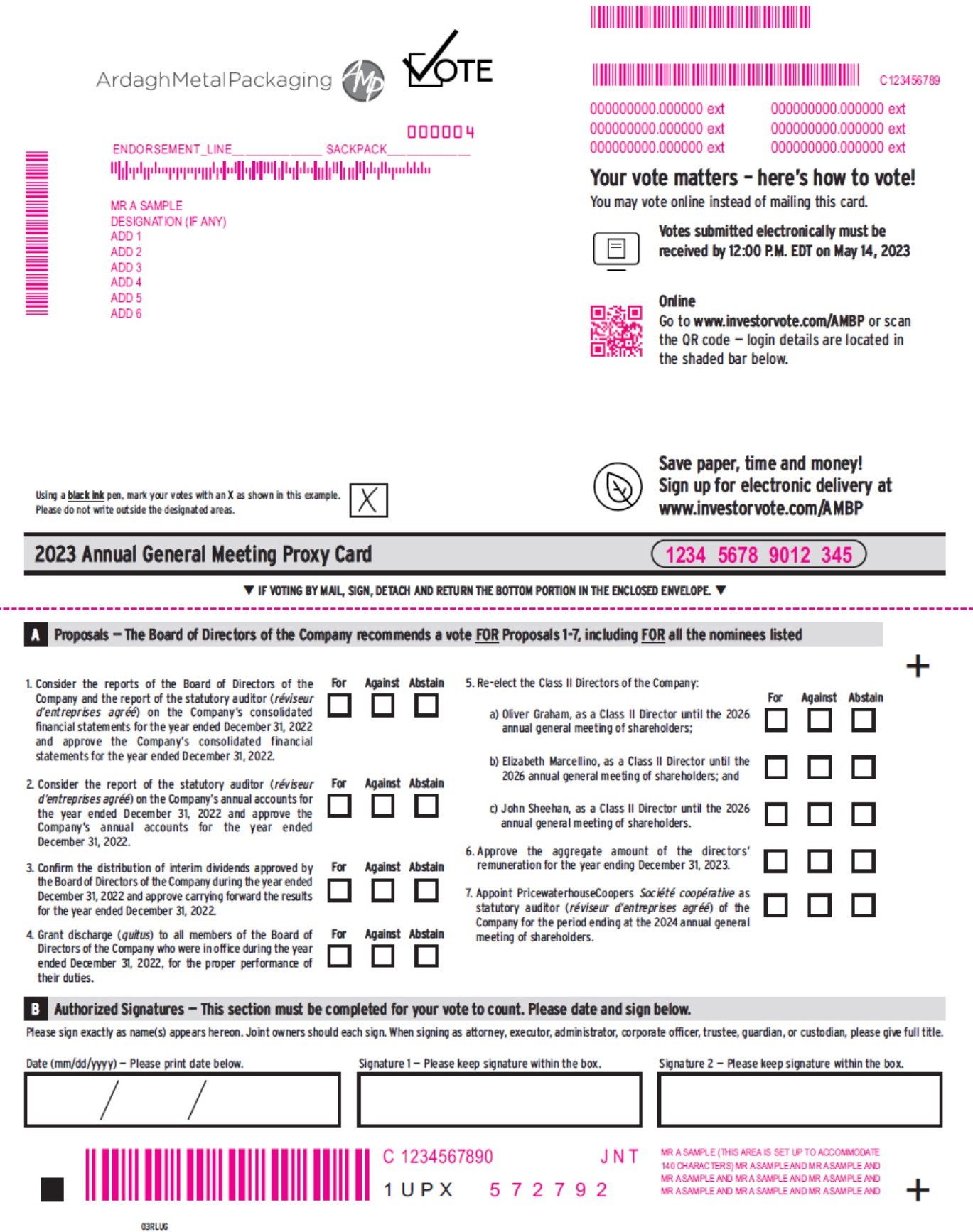

1UPX a) Oliver Graham, as a Class II Director until the 2026 annual general meeting of shareholders; b) Elizabeth Marcellino, as a Class II Director until the 2026 annual general meeting of shareholders; and c) John Sheehan, as a Class II Director until the 2026 annual general meeting of shareholders. For Against Abstain Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. 03RLUG + + q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q 2023 Annual General Meeting Proxy Card 1. Consider the reports of the Board of Directors of the Company and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s consolidated financial statements for the year ended December 31, 2022 and approve the Company’s consolidated financial statements for the year ended December 31, 2022. 6. Approve the aggregate amount of the directors’ remuneration for the year ending December 31, 2023. For Against Abstain 5. Re-elect the Class II Directors of the Company: 2. Consider the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s annual accounts for the year ended December 31, 2022 and approve the Company’s annual accounts for the year ended December 31, 2022. 7. Appoint PricewaterhouseCoopers Société coopérative as statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the 2024 annual general meeting of shareholders. 3. Confirm the distribution of interim dividends approved by the Board of Directors of the Company during the year ended December 31, 2022 and approve carrying forward the results for the year ended December 31, 2022. For Against Abstain For Against Abstain 4. Grant discharge (quitus) to all members of the Board of Directors of the Company who were in office during the year ended December 31, 2022, for the proper performance of their duties. For Against Abstain Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. B Authorized Signatures — This section must be completed for your vote to count. Please date and sign below. A Proposals — The Board of Directors of the Company recommends a vote FOR Proposals 1-7, including FOR all the nominees listed 000004 MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 ENDORSEMENT_LINE______________ SACKPACK_____________ 1234 5678 9012 345 MMMMMMMMM MMMMMMMMMMMMMMM 572792 MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND C 1234567890 J N T C123456789 MMMMMMMMMMMM MMMMMMM 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext If no electronic voting, delete QR code and control # Δ ≈ You may vote online instead of mailing this card. Online Go to www.investorvote.com/AMBP or scan the QR code — login details are located in the shaded bar below. Save paper, time and money! Sign up for electronic delivery at www.investorvote.com/AMBP Votes submitted electronically must be received by 12:00 P.M. EDT on May 14, 2023 Your vote matters – here’s how to vote! |

|

Small steps make an impact. Help the environment by consenting to receive electronic delivery, sign up at www.investorvote.com/AMBP This proxy is solicited by the Board of Directors of the Company for use at Ardagh Metal Packaging S.A.’s Annual General Meeting of Shareholders on May 16, 2023 or any postponement(s) or adjournment(s) thereof. The undersigned, having read the Convening Notice and Proxy Statement, dated April 11, 2023, receipt of which is acknowledged hereby, does hereby appoint Paul Coulson, Oliver Graham, John Sheehan and Hermanus Troskie, and each of them, proxies and attorneys-in-fact, each with full power of substitution, for and in the name of the undersigned, to vote and act at the Annual General Meeting of the Shareholders (the "Annual General Meeting") of Ardagh Metal Packaging S.A. (the "Company") to be held at 12:00 p.m. Luxembourg time on May 16, 2023 at the Company's registered office, 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg, and at any postponement(s) or adjournment(s) thereof, with respect to all of the ordinary shares of the undersigned, standing in the name of the undersigned or with respect to which the undersigned is entitled to vote or act at the Annual General Meeting, with all of the powers that the undersigned would possess if personally present and acting as set forth on the reverse side hereof. This proxy, when properly executed and returned in a timely manner, will be voted in the manner directed on the reverse side hereof. If you submit a proxy but do not direct how your shares will be voted, the individuals named as proxies will vote your shares "FOR" the election of each of the nominees for director and "FOR" each of the other proposals identified herein. It is not expected that any other matters will be brought before the Annual General Meeting. If, however, other matters are properly presented, the individuals named as proxies will note in accordance with their discretion with respect to such matters. (Items to be voted appear on reverse side.) Proxy - Ardagh Metal Packaging S.A. q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Change of Address — Please print new address below. Comments — Please print your comments below. C Non-Voting Items + + Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on May 16, 2023: Information is now available regarding the 2023 Annual General Meeting of Shareholders at https://www.ardaghmetalpackaging.com/corporate/investors/agm. |